In today’s fast-paced markets, traders face a constant tug-of-war: lock in quick gains or stay in the trend for a home-run payoff? Multi-positional trading bridges that gap. By staggering profit targets, dynamically reallocating risk, using ATR- and rule-based stops, and even developing multiple swing positions, you can protect capital and let winners run. Below, we’ll walk through a concrete example, highlight how you keep total risk within your 1–3 % threshold, compare this to a single-entry approach, and give you practical next steps.

How It Works: A Mini Case Study

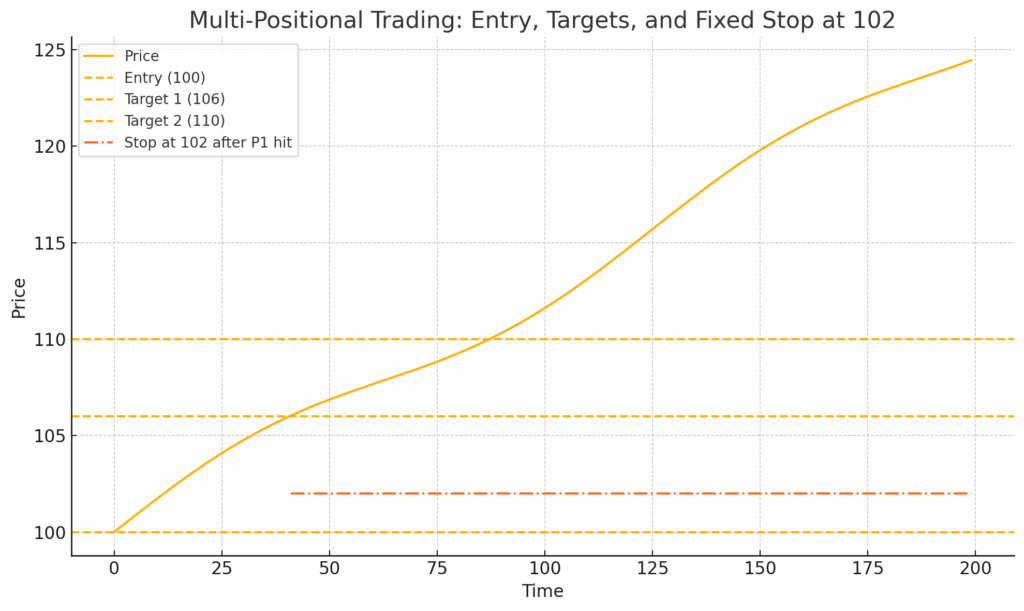

You enter one “master” trade at 100, risking 1 % per leg. As each leg hits its target, you free up risk to deploy on the next—never exceeding 3 % total exposure.

| Position | Target (R:R) | Exit Price | Stop-Loss After P1 | Risk Freed |

|---|---|---|---|---|

| 1 | 1 : 3 | 106 | — | 1 % freed |

| 2 | 1 : 5 | 110 | Move to 102 (70 % beyond P1) | + 1 % freed |

| 3 | Let run (1 : 20+) | 120+ | Keep at 102 (pre-daily-range) | — |

First Milestone (1 : 3): Close Position 1 at 106, freeing 1 %—your “safety harness.”

Second Milestone (1 : 5): Exit Position 2 at 110, pocket another 1 % and set stops for Positions 2 & 3 to 102, which sits more than 70 % of the 6-point P1 move below the exit—outside the Fibonacci “golden pocket.”

Post-Day 1 Management: Once a full daily bar has closed, use your daily high-low range indicator to recalibrate the 70 % boundary instead of a fixed 102.

On deeper pullbacks you can layer fresh swing entries (each up to 1 % risk) at fib levels, building a portfolio of runners—all while staying under a 3 % cap.

Adaptive Risk Management Meets Profit Maximization

Key Advantages

Build Multiple Swing Positions: Each profit-taking leg frees capital for another swing, spawning overlapping trades with distinct horizons.

Risk Always Capped at 1–3 %: You never exceed your comfort zone, even as you redeploy freed risk.

70 %-Outside Fib Stops: Moving stops to 102 keeps you out of the golden pocket, avoiding normal retracements—then switch to your daily-range guide for ongoing protection.

Capture Quick Gains & Home Runs: Staggered targets lock in initial profits while still chasing big moves.

Pullback Layering: Adding on retracements lowers your average cost and boosts upside, all within a disciplined framework.

Momentum-Aligned Entries: Only fully triggered legs (price > entry) participate—no chasing false breakouts.

Honest Trade-Offs

Higher Management Load: Tracking fixed and daily-range stops, multiple legs, and layering requires discipline.

Cost & Slippage: More trades mean more fees—include these in your R-multiple calculations.

Indicator Dependence: The daily-range guide is powerful, but any indicator can lag in fast markets—always cross-check price action.

Multi-Positional vs. Single-Entry

| Multi-Positional | Single-Entry |

|---|---|

| Staggered exits (1 : 3 → 1 : 5 → 1 : 20+) | Single exit at 1 : 5 |

| Stops at 102 (70 % outside fib) → daily-range | Static stop-loss |

| Risk redeployed after each win (max 3 % total) | All risk tied up until exit |

| Builds multiple concurrent swing positions | No cost-averaging |

| Higher operational complexity | Simpler, one-and-done |

| Ideal for “elite risk control” | Best for straightforward setups |

Think of Position 1 as your safety harness, Position 2’s stop at 102 as your secure rope outside the golden pocket, and the daily-range guide as your summit checkpoint—keeping you safe at every stage.

Next Steps: Put It Into Practice

Chart Worksheet

Plot your tool’s daily-range band and mark entry = 100, targets = 106 & 110, then sketch a P1-stop at 102 (70 % of that 6-point move).

Paper-Trade Challenge

Simulate 10 trades, 1 % per leg. Record each P1 & P2 exit, stop move to 102, daily-range recalibration, R-multiples, and any whipsaws.

Titan Debrief

Share your biggest runner, discuss how the 70 % stop and daily-range indicator performed, and trade notes on layering during volatility.

Considered Thoughts

Capital Preservation Meets Growth

By moving stops to 102—outside the 70 % fib zone—you avoid normal retracements, while redeploying freed risk to compound gains without ever exceeding 3 % total.Moving your stops to 70 % beyond the first profit, smartly keeps you outside normal Fibonacci retracements, so minor pullbacks won’t shake you out.

By freeing up 1 % risk at each milestone and redeploying it, you’re effectively compounding your edge without ever exposing more than 3 %. That’s a textbook way to marry safety with scalability.

Developing Multiple Swing Positions

One master entry blossoms into a suite of overlapping trades, each riding its own catalyst and timeframe—smoothing returns across market regimes.Indicator Integration & Flexibility

Your daily high-low range guide adapts the 70 % boundary to evolving volatility, keeping stops relevant and reducing manual guesswork. It’ll help you stay in winners when markets broaden out, and tighten when they contractReal-World Execution Risks

Complexity: Precise stop moves and layering demand either a bullet-proof routine or semi-automation to eliminate errors.

Parameter Sensitivity: The 70 % threshold and P1 size should be backtested across instruments and timeframes to validate robustness.

Costs & Slippage: More legs and adjustments increase fees—ensure your net R-multiples remain attractive.

Psychology & Routine

Juggling multiple legs, fixed/dynamic stops, and layering rules can be stressful. A clear checklist or automated alerts will keep emotional hesitation at bay. Often the simplest way is to work with just 2 positions then add a third, and as these run and free risk layer in again knowing previous positions are in profit and at collectively move stops end of session.

Bottom Line:

This is a high-conviction, disciplined framework that fuses capital protection with growth. With thorough backtests, reliable indicator integration, and rock-solid routines, multi-positional trading can transform modest setups into a diversified portfolio of swing winners.

Titan Protect provides members with exclusive access to advanced trading view indicators, enabling sophisticated multi-positional trading strategies. Our tools are designed to help you identify optimal entry and exit points, manage risk effectively, and maximize your profit potential across diverse market conditions. Join our community to unlock the full power of informed trading.