🛡️ Titan Protect | Matrix x Guide Synergy: NAS100 Ignites, SPX Coils

📆 Thursday, July 4, 2025 | ⏰ 13:00 London / 08:00 NY

📦 Status: Confirmed Tier 1 Breakout on NAS100 | SPX Holding in Structural Compression

🧭 Market Intelligence Recap

Thursday’s session delivered a high-grade divergence:

NAS100USD triggered a textbook Tier 1 long, cleanly confirming a breakout via the Titan stack.

SPX500USD remained in compression, neutral but informative.

The contrast is powerful. NAS aligned signal, structure, and slope across the board. SPX is in preparation, with no signal fire — a reminder that waiting is a position when backed by system clarity.

This breakdown delivers both setups in full detail — exactly how Titan read them in real time.

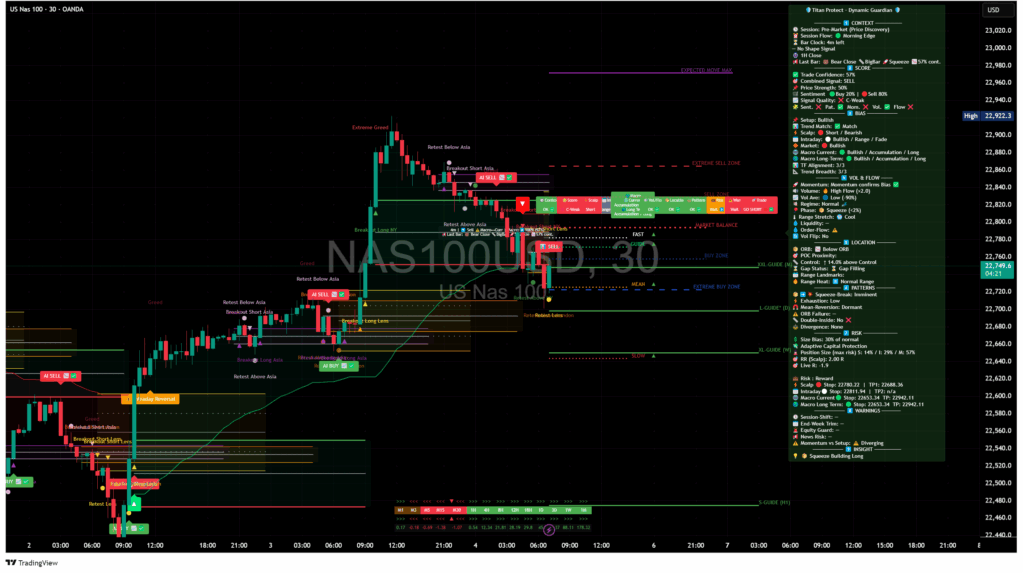

🔥 NAS100USD — Structure, Timing, and Flow in Full Alignment

🧠 [TP] Matrix Guardian — Signal Logic & Panel Read

Quick Panel Status

✅ Signal Active: Long

✅ Flow Match: Short, Intraday, and HTF all green

✅ Bias Confirmed

✅ No Conflict Flags or Reversals

🟢 Signal Score: High

Info Panel Observations

Trend structure steepening

Signal clusters aligning without exhaustion

Sentiment direction consistent with flow

No overrides or fade conditions

ORB (Opening Range Box)

🟩 ORB High: ~20,360 — price broke with conviction

🟥 ORB Low: ~20,295 — never retested = low risk

🔑 Entry: Valid above 20,365

🔐 Stop logic: Clean below 20,300 (beneath compression)

📈 [TP] Guide — Flow Structure, Signal Arrow, and Cloud Confirmation

Guide Flow Stack

Fast > Guide > Mean > Slow = Full Bullish Stack

Composite Slope: Positive and accelerating

Signal Arrow ▲ printed near 20,360

Cloud flipped slope concurrent with breakout

Guide Level Highlights

S-GUIDE (1H): 20,320 — breakout line

M-GUIDE (4H): 20,270 — rising, supportive slope

L-GUIDE (1D): 20,140 — confirms longer-term structure intact

Compression Context

Tight pre-break range (20,240–20,320)

Cloud apex breakout into expansion phase

No flattening in Fast/Guide layers — no fakeout risk

🎯 Trade Execution Zones

| Component | Level | Role |

|---|---|---|

| Entry Zone | 20,365–20,380 | Post-breakout + Guide signal arrow |

| Risk Layer | 20,300 | Beneath S-GUIDE + ORB low |

| Target 1 | 20,470 | Cloud apex projection |

| Target 2 | 20,600 | Exhaustion zone (Guide-projected high) |

🧠 Titan Take

This is a Tier 1 Confirmed Long. Every core Titan layer agreed:

ORB confirmed breakout

Matrix flow confirmed alignment

Guide slope flipped at the right time

Signal arrow gave the permission

No sentiment blocks, no counter-triggers

This is what Titan members mean by “Don’t predict. Wait for structure.”

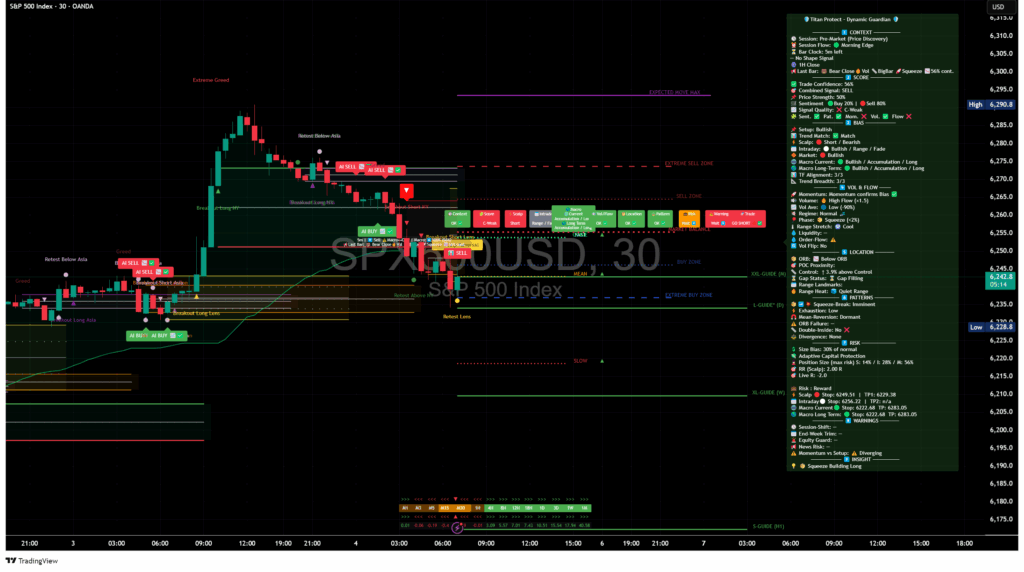

🌀 SPX500USD — Contained Coil, Awaiting Confirmation

🧠 [TP] Matrix Guardian — Clean Non-Signal

Quick Panel Status

⚠️ Watching State

❌ Signal Inactive

⚠️ Mixed Flow: Short-term uncertain, HTF still positive

✅ HTF Supportive

❌ Entry Denied — conditions not met

Info Panel Observations

Momentum weakening short-term

Structure support remains intact

No sentiment contradiction

Panel neutral — not warning, not confirming

ORB (Opening Range Box)

ORB Range: 5,515–5,550

Price remains inside

No breakout = no action

No reversal either = do not fade

📈 [TP] Guide — Structural Squeeze

Flow Stack

Fast flattening into Guide

Mean + Slow supportive but flat

No signal arrows → no directional mandate

Trend slope nearly horizontal across stack

Guide Level Anchors

S-GUIDE (1H): 5,520 – support floor

M-GUIDE (4H): 5,500s – base forming

L-GUIDE (1D): 5,470 – rising, long-term strength

Compression Context

Cloud range compressing 5,525–5,545

No slope shift yet

Pre-ignition phase — wait mode

🎯 Trade Framework

| Component | Level | Role |

|---|---|---|

| Compression Box | 5,515–5,550 | Setup range |

| Trigger Breakout | >5,550 | Long trigger if slope + flow align |

| Reversal Risk | <5,515 + arrow | Short if failed structure and reversal trigger |

| Cloud Targets | 5,565 / 5,585 | If breakout holds, next extension zones |

🧠 Titan Take

This is what the system filters best: range, noise, and emotional trades.

SPX is compressing — not moving.

Guide and Matrix agree: this is not ready.

For Titan members, the read is clear:

Hold fire.

Prepare levels.

Watch slope, not just price.

We’re not early. We’re accurate.

📊 Titan Flow Summary

| Asset | Bias | Matrix Signal | Guide Structure | Signal State |

|---|---|---|---|---|

| NAS100USD | 🟢 Bullish | ✅ AI Long Active | Fully Stacked Bull | Confirmed |

| SPX500USD | ⚖️ Neutral | ❌ Watching Only | Coiling/Compression | Awaiting |

🔒 Dynamic Guardian Full Panel Snapshot (Retrospective)

Captured at 12:00 London — same bar as the NAS100 ignition. This was the Guardian Panel read that validated full system alignment:

“Ultra-Consensus Long” — when all conditions align across structure, slope, sentiment, trend, and risk.”

(Selected rows only for brevity — full panel available to members.)

| Metric | Value | Interpretation |

|---|---|---|

| 🎛️ Combined Signal | 🟢 BUY | All signal modules aligned bullish |

| 📈 Trend Match | Match | Higher- and lower-timeframe aligned |

| 📊 TF Alignment | 3 / 3 | All tracked timeframes confirm direction |

| 🔥 Trend Breadth | 3 / 3 | Market width supported move |

| 🛠️ Setup | Bullish | Compression resolved into directional move |

| ⚡ Phase | Expansion (> 6%) | High-volatility environment |

| 🏷️ Signal Quality | C – Weak | Tradable but not high-grading — stay tactical |

| 💬 Sentiment | 🟢 Buy 20% / 🔴 Sell 80% | Crowd heavily short → fade bias favours long |

| 📏 Position Size | S: 14% / L: 28% / M: 56% | Risk model scaled by trade type |

| 🧠 Insight | Ultra-Consensus Long | Strongest alignment score available |

✒️ Titan Specialist Summary

This is the difference between trading on noise and trading on structure.

NAS100 gave us a signal worth taking — and a system that confirmed it

SPX500 gave us structure worth watching — and a system that told us to wait

Not every day delivers a trade. But every day delivers a read.

And Titan reads with conviction.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

📉 Technical Analysis data reflects positioning as of July 4 (reported July 4)

📦 Archive Reference: 19.TITAN.040725-BLOG.md