🛡️ Titan Signals

SPX Confirms Breakdown, NDX Trapped Below Reclaim — Dual Reversal Trigger Active

📆 Friday, August 1, 2025 | ⏰ Pre-Market → NY Session

🎯 Trade Type Focus: Intraday, Macro, Scalp Overlay

🧠 SIGNAL STRATEGY SNAPSHOT – KEY TAKEAWAYS

📉 Dual Breakdown Detected

• SPX has lost structure at the midpoint and now prints confirmed bearish flow bias.

• NDX sits firmly below its trap reclaim zone, making the failure explicit.

• No Ultra-Consensus in sight.

• Signal quality continues to deteriorate — across both timeframes and types.

⚠️ Institutional Flow Has Flipped

• Both indices now show AI SELL clusters

• Momentum and Risk Pressure both point sharply down

• Scalp, Intraday, and Daily layers now aligned for short bias setups only

🧠 Reversal confirmed. Risk is on the short side until proven otherwise.

🧱 DAILY TIMEFRAME CONFIRMATION

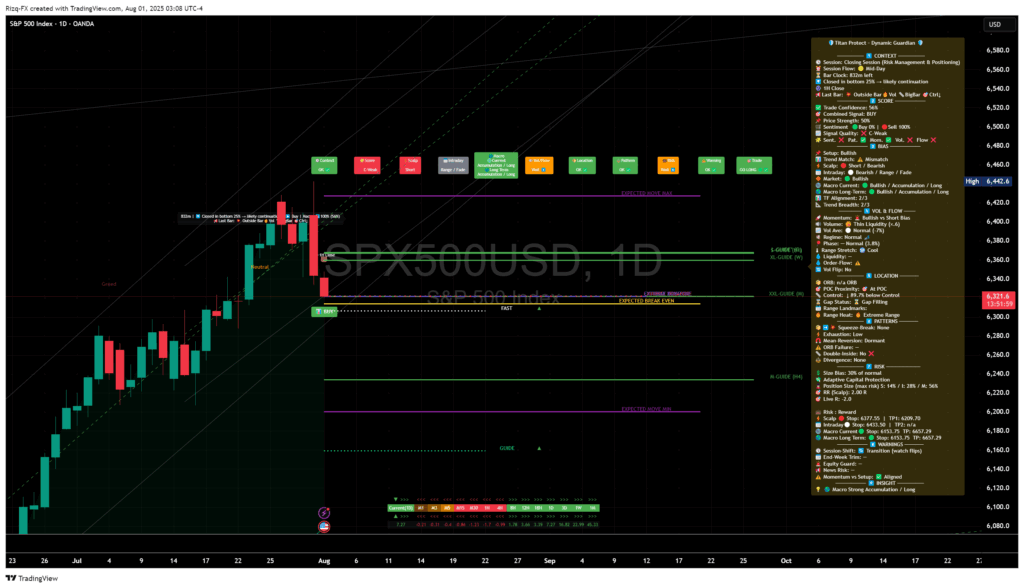

📉 SPX500USD 1D

⚠️ Score: C

⚠️ Vol/Flow = Diverging

⚠️ Momentum = Bearish

🟠 Macro = Long-Term Accumulation (but weakening)

📍 Price: Rejected 6,343 (FAST) → Closed beneath Mean + Guide

🛡️ Setup Context:

• Sentiment = Weakening, low conviction

• Signal Quality = Moderate → Lowered

• Flow vs Volume = Disconnected

• Pattern = Failed continuation, trend stall

• Macro Long-Term = Still Long but under review

• Max Risk Profile: S: 13% / L: 26% / M: 61%

🎯 Strategy:

Short bias valid while price remains under 6,343

→ First fade zone: 6,275

→ Full reversal risk: 6,181–6,095

Reclaiming 6,343+ with conviction is required to restore long setups.

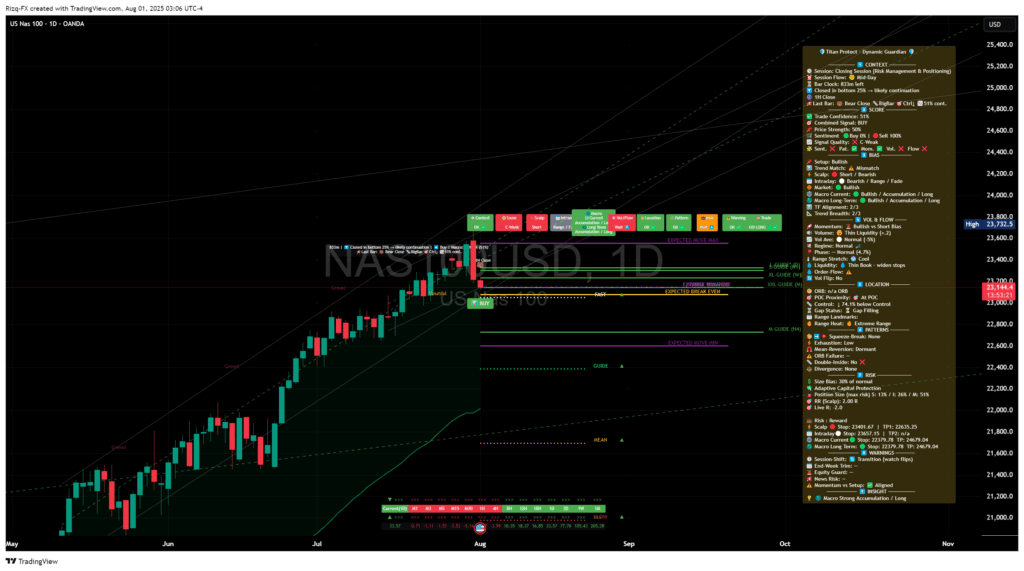

📉 NAS100USD 1D

⚠️ Score: C-

⚠️ Vol/Flow = Rejected

⚠️ Momentum = Strongly Diverging

🟥 Macro = Trap Confirmed / Accumulation Invalidated

📍 Price: Closed beneath 23,150 → Below FAST, Guide, and ORB structure

🛡️ Setup Context:

• Sentiment = Fragile

• Signal Quality = Weak → Short cluster active

• Flow vs Volume = Misaligned

• Pattern = Trap rejection with follow-through

• Macro Long-Term = Accumulation bias under full threat

• Max Risk Profile: S: 13% / L: 26% / M: 61%

🎯 Strategy:

Short bias confirmed while below 23,150

→ Reversal floor test at 22,880 likely

→ Below 22,880 opens downside to 22,500

Longs only valid on full reclaim of 23,300 with signal strength grade B+ or better.

🛡️ SPX and NDX Confirm Trap Unwind

Titan Signal Intelligence now shows a confirmed reversal bias across both major US indices. SPX has lost channel structure, while NDX failed its reclaim — with all short-term momentum now pointing lower.

🔒 Members Only – Titan Session Outlook

🧠 How Might the Next Session Play Out?

🔍 Forward Bias Projection from Final Guardian Panel States

🔒 Want the Full Panel Breakdown?

🛡️ The Titan Guardian doesn’t just show buy/sell — it decodes structure, flow, and momentum like no other.

This week’s divergence between SPX and NDX? The panel saw it coming.

✅ Get the full cheat-sheet,

✅ Detailed RR zones,

✅ Session forecast,

✅ Adaptive sizing — before the move happens.

🧠 Join Titan Alpha Access today → and trade what institutions track, not what retail guesses.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

📉 Titan Signal data reflects multi-timeframe trade setup detection as of July 31, 2025

✍️ Analyst: Titan Protect | Signals Division

⚠️ Educational content only. Not investment advice.

🔒 Visual Interpretation Only – Proprietary Indicators Not Disclosed