🛡️ Titan Tactics

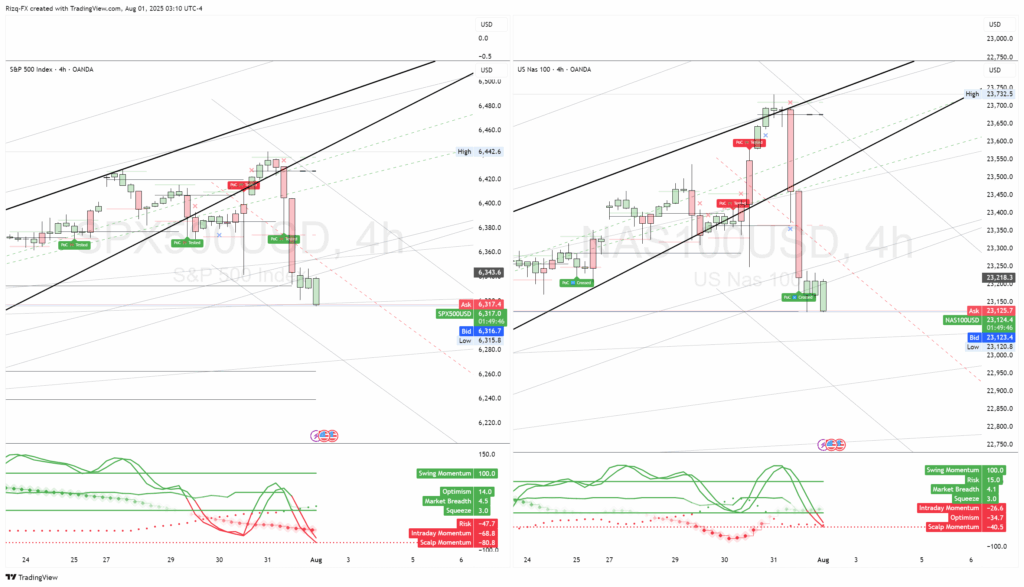

SPX Fails Midpoint, NDX Trapped Again — Momentum Confirms Broad Breakdown

📆 Friday, August 1, 2025 | ⏰ 08:13 BST / 03:13 EST

📦 Status: Confirmed Channel Break + Trap Reversal Active

🔭 MARKET STRUCTURE SNAPSHOT

What looked like early-week resilience has broken decisively. Both SPX and NAS100 have:

• Lost their channel posture

• Printed lower highs

• Triggered clean rejection moves backed by collapsing momentum

🔹 SPX cleanly rejected at its mid-channel resistance, then flushed through both mean and slope support. Structure is now decisively broken — this is no longer just a pullback.

🔹 NDX again trapped at highs after a false break above its upper reaction band. The failed break produced a wick trap, followed by a sharp reclaim failure, confirming rejection from structural compression.

This isn’t a fakeout. It’s structural failure backed by momentum unwind.

📉 MOMENTUM BREAKDOWN — CONFIRMATION ACROSS ALL TIMEFRAMES

| Momentum Type | SPX500USD | NAS100USD |

|---|---|---|

| Swing Momentum | ✅ 100.0 | ✅ 100.0 |

| Intraday Momentum | 🔻 –68.9 | 🔻 –26.7 |

| Scalp Momentum | 🔻 –81.0 | 🔻 –40.8 |

| Optimism Index | 🔻 –74.7 | 🔻 –34.7 |

| Risk Pressure | 🔻 –77.7 | 🔻 –15.0 |

🧠 Interpretation:

Momentum is now fully aligned to the downside on SPX, with NASDAQ lagging slightly but confirming. Both have turned from neutral unwind to active flow rejection. Optimism and risk appetite are evaporating fast — confirming this is no longer dip-buying territory.

🧭 STRUCTURAL LEVELS TO WATCH

🔻 S&P 500 (SPX500USD)

• 🔴 Breakdown Zone: < 6,325 → Triggered

• 🧠 “Clean loss of trend mean confirms downside compression.”

• Next Support Zone: 6,181

• ⚠️ Reclaim Zone: 6,343–6,390

🔻 NASDAQ 100 (NAS100USD)

• 🔴 Trap Zone: 23,620–23,730 → Confirmed rejection

• ⚠️ Compression Retest Zone: 23,150–23,220

• Breakdown Floor: 23,000

• 🧠 “Failure to reclaim above 23,220 confirms full wedge unwind.”

🎯 STRATEGIC OUTLOOK — STRUCTURE SPEAKS LOUDLY

This is now a flow-confirmed reversal with:

• SPX leading momentum + structure breakdown

• NDX confirming trap rejection

• No rescue from swing momentum — it’s maxed and pinned

📌 Key Notes:

• Risk and optimism have both collapsed

• Visual slope channels are broken on both SPX and NAS100

• Side-by-side charts confirm rejection at top structure → lower high behaviour dominant

💡 This is not a dip. This is a structural unwind with all flow signals aligned.

The edge is now with continued short bias unless price reclaims key failure levels fast.

📢 CHARTS INCLUDED

✅ SPX vs NAS100 Side-by-Side 4H Chart → Trap + Rejection Confirmed

✅ SPX 4H Full Channel Flush Breakdown

✅ NAS100 1H Reclaim Failure + Momentum Collapse

✅ SPX 1H False Break + Risk Drain

✅ Momentum Panel Readouts (Scalp → Swing)

📌 FINAL TAKE

This is a momentum-aligned unwind.

Structure is broken. Risk is off.

Unless price can reclaim failure levels early in session, continuation shorts remain in play.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

📉 Titan Tactics data reflects positioning as of August 1, 2025 (reported August 1, 2025)

✍️ Analyst: Titan Protect | Titan Tactics Division

⚠️ Educational content only. Not investment advice. Titan Protect does not offer financial services or broker recommendations.