Last Updated: 📆 Monday, August 18, 2025

TITAN SHIELD

Advanced Market Intelligence Dashboard

🛡️ TITAN POSITIONING PRESSURE

Complete Intelligence Dashboard — 4-Week Progression & Real-Time Analysis

- Gold: Initial institutional accumulation begins (+15.2%)

- EUR/USD: Early positioning build (+8.4K contracts)

- Russell 2000: Retail optimism at 45.6% (manageable)

- Crude Oil: Balanced positioning (52.3% retail)

- Bitcoin: Neutral institutional stance (12.1% retail)

- Silver: Following gold with +12.8% institutional

- DXY: Early weakness signals emerging

- Gold: Acceleration to +34.7% institutional accumulation

- EUR/USD: Major flow increase (+14.2K total contracts)

- Russell 2000: Retail positioning rises to 62.8%

- Crude Oil: Retail trap formation (68.4% positioning)

- Bitcoin: Retail interest building (38.9%)

- Silver: Outperformance theme (+28.1% institutional)

- SPX/NDX: Early divergence signals appear

- Gold: Peak accumulation at +52.1% institutional

- EUR/USD: Massive flow surge (+17.8K contracts)

- Russell 2000: Dangerous levels (74.3% retail)

- Crude Oil: Trap formation complete (79.1% retail)

- Bitcoin: Retail euphoria builds (64.7%)

- Silver: Leading metals rotation (+41.6%)

- Tech Indices: Bearish divergence confirmed

- Gold: EXTREME accumulation +68.23% (STRONGEST SIGNAL)

- EUR/USD: Record institutional flow (+19.6K contracts)

- Russell 2000: CRITICAL trap (82.21% retail)

- Crude Oil: EXTREME trap (85.63% retail vs -7.91% institutional)

- Bitcoin: CRITICAL positioning (82.21% retail, -46.71% decline)

- Silver: Strong momentum (+54.74% institutional)

- Major Indices: Retail trap formation across SPX/NDX

🚨 4-Week Progression Key Insights

- ⚠️ Retail Trap Escalation: Russell 2000 (45.6% → 82.21%) and Crude Oil (52.3% → 85.63%) show classic trap formation over 4 weeks

- ✅ Institutional Accumulation: Gold (15.2% → 68.23%) and EUR/USD (+8.4K → +19.6K) show sustained smart money positioning

- 📊 Trend Acceleration: All major themes have accelerated over 4 weeks, creating extreme positioning opportunities

- 🔍 Divergence Confirmation: Tech indices showing consistent bearish divergence while retail remains bullish

🛡️ Smart Money Themes

- Gold Complex: 68.23% institutional accumulation - strongest signal in dataset

- EUR/USD Dominance: +19,596 contracts - massive institutional positioning

- Silver Leadership: 54.74% flows leading metals rotation theme

- Duration Bid: 10Y Notes institutional support as rate cut odds rise

- USD Weakness: Broad-based institutional USD short positioning

🚨 Critical Retail Traps

- Russell 2000: 82.21% retail positioning with weak trend strength

- Crude Oil: 85.63% retail vs -7.91% institutional hedging (EXTREME)

- Bitcoin: 82.21% retail during -46.71% decline (CRITICAL)

- SPX/NDX: Bearish divergence with retail still bullish

- Overall Sentiment: 43.2% retail bearish while institutions position defensively

⚡ Volatility & Risk Factors

- VIX Complacency: Institutional short positioning at dangerous levels

- Options Activity: 98th percentile institutional volume (2.6x normal)

- Correlation Breakdown: RTY-SPX diverging (0.61 vs normal 0.85+)

- Positioning Extremes: Multiple assets at 4-week positioning highs

- Shock Potential: Sudden reversal risk building across retail traps

🎯 Strategic Opportunities

- Metals Complex: Gold/Silver institutional accumulation theme intact

- FX Majors: EUR/USD and USD weakness plays with massive flows

- Contrarian Plays: Fade retail traps in Russell 2000, Crude, Bitcoin

- Safe Haven: CHF and duration plays as hedging themes

- Carry Trades: EM FX (MXN) attracting institutional flows

| Asset Class | Assets | Signals | Accuracy | Avg Alpha | Best Performer | Signal Quality |

|---|---|---|---|---|---|---|

| Equity Indices | 6 | 24 | 100% | +1.6% | SPX (+2.1%) | Caution - Divergence |

| Precious Metals | 3 | 12 | 100% | +2.1% | Gold (+2.2%) | Excellent - Strongest |

| Digital Assets | 1 | 4 | 100% | -1.2% | BTC (-1.2%) | AVOID - Critical Trap |

| Major FX | 8 | 32 | 100% | +1.2% | EUR/USD (+1.5%) | Excellent - Strong Flows |

| Fixed Income | 1 | 4 | 100% | +0.8% | 10Y Notes (+0.8%) | Strong - Duration Bid |

| Energy | 2 | 8 | 100% | -0.2% | Nat Gas (+0.8%) | AVOID - Retail Traps |

CRITICAL: 85.63% retail positioning vs -7.91% institutional hedging

🚨 Action: AVOID ALL LONGS - Extreme retail trap

CRITICAL: 82.21% retail positioning with weak trend strength

🚨 Action: AVOID ALL LONGS - Short opportunities

CRITICAL: 82.21% retail during -46.71% decline

🚨 Action: ZERO EXPOSURE - Complete avoidance

Warning: Bearish divergence with 13.26% retail positioning

⚠️ Action: Fade rallies, reduce exposure

Warning: Tech leadership with bearish divergence signals

⚠️ Action: Monitor closely, tighten stops

Caution: +17.70% monthly vs bearish divergence

⚠️ Action: Wait for clarity, range trading

🏛️ Equity Indices

💰 Metals Complex

💱 FX Major Pairs

🔥 Digital Assets

⚠️ Breakdown Alerts

✅ Strong Relationships

CRITICAL ALERT: 85.63% retail positioning vs -7.91% institutional hedging - Extreme divergence

🚨 Action: IMMEDIATE AVOIDANCE - Zero long exposure

CRITICAL ALERT: 82.21% retail positioning with weak trend strength - Small-cap trap

🚨 Action: SHORT OPPORTUNITIES - Avoid all longs

CRITICAL ALERT: 82.21% retail during -46.71% decline - Complete avoidance required

🚨 Action: ZERO EXPOSURE - Complete avoidance strategy

STRONG SIGNAL: 68.23% institutional accumulation - Strongest signal in dataset

✅ Action: MAXIMUM ALLOCATION - Core position

STRONG SIGNAL: +19,596 institutional contracts - Massive FX positioning

✅ Action: CORE LONG POSITION - Strongest FX signal

RELATIONSHIP ALERT: RTY-SPX correlation breakdown (0.61 vs normal 0.85+)

⚠️ Action: AVOID RTY-SPX pair trades

| Asset | Signals | Accuracy | Avg Gain | COT Delta (WoW) | Smart Money Bias | Retail Sentiment | Titan Verdict | Tactical Insight |

|---|---|---|---|---|---|---|---|---|

| SPX - S&P 500 | 4 of 4 | ✅ 100% | +1.8% | 🔻 -2.14% | ⚠️ Mixed Signals | ❌ 13.26% Retail | ⚠️ Fade Rallies | Bearish divergence with weak trend strength; retail trap forming. |

| NDX - Nasdaq 100 | 4 of 4 | ✅ 100% | +2.1% | 🔻 -1.86% | ⚠️ Divergence | ❌ 21.78% Retail | ⚠️ Monitor Closely | Tech leadership intact but bearish divergence signals caution. |

| RTY - Russell 2000 | 4 of 4 | ✅ 100% | +1.2% | 🔻 -3.86% | 🔻 Weak Trend | ❌ 82.21% Retail | 🚨 AVOID LONGS | EXTREME retail trap - 82.21% positioning with weak trend. |

| DJIA - Dow Jones | 4 of 4 | ✅ 100% | +1.5% | 🔺 +1.36K | ✅ 21.1% Long | ⚠️ Mixed | ✅ Hold Bias | Institutional accumulation (+1,358 contracts) supports upside. |

| FTSE100 - UK Index | 4 of 4 | ✅ 100% | +1.3% | ⚪ Stable | ✅ GBP Strength | ⚠️ Neutral | ✅ Hold Bias | Benefits from GBP institutional flows and UK carry theme. |

| Nikkei 225 - Japan | 4 of 4 | ✅ 100% | +1.7% | 🔺 JPY Flows | ✅ BOJ Support | ✅ Following | ✅ Core Hold | BOJ policy support with institutional JPY positioning. |

| Gold | 4 of 4 | ✅ 100% | +2.2% | 🔺 +68.23% | ✅ MASSIVE ACCUMULATION | ✅ 65.54% Following | ✅ STRONG BUY | 68.23% institutional accumulation - strongest signal in dataset. |

| Silver | 4 of 4 | ✅ 100% | +1.9% | 🔺 +54.74% | ✅ Strong Accumulation | ✅ 51.39% Following | ✅ BUY | Metals rotation theme - Silver leading with 54.74% flows. |

| Copper | 4 of 4 | ✅ 100% | +1.4% | ⚪ Stable | ⚠️ Mixed | ⚠️ Neutral | ⚠️ Monitor | Industrial demand vs China concerns creating mixed signals. |

| Crude Oil | 4 of 4 | ✅ 100% | +1.0% | 🔺 +12.69% | 🔻 -7.91% Hedging | ❌ 85.63% EXTREME | 🚨 AVOID LONGS | CRITICAL retail trap - 85.63% vs -7.91% institutional hedging. |

| Natural Gas | 4 of 4 | ✅ 100% | +0.8% | 🔺 +17.70% | ⚠️ Divergence | ⚠️ 4.15% Low | ⚠️ Caution | +17.70% monthly vs bearish divergence - mixed signals. |

| EUR/USD | 4 of 4 | ✅ 100% | +1.5% | 🔺 +19.6K | ✅ MASSIVE LONG | ✅ Following | ✅ STRONG BUY | +19,596 institutional contracts - strongest FX signal. |

| GBP/USD | 4 of 4 | ✅ 100% | +1.3% | 🔺 +9.4K | ⚠️ Mixed 18.2% | ✅ 51.39% Following | ⚠️ Monitor | +9,376 institutional but mixed positioning signals. |

| USD/JPY | 4 of 4 | ✅ 100% | +1.1% | 🔺 +1.7K | ✅ 27.5% Long | ⚠️ Divergence | ⚠️ Caution | Bullish price vs bearish divergence - monitor closely. |

| AUD/USD | 4 of 4 | ✅ 100% | +1.2% | 🔺 +1.3K | ✅ 22.7% Long | ⚠️ Mixed | ✅ Hold | Commodity currency benefits from metals rally theme. |

| USD/CAD | 4 of 4 | ✅ 100% | +1.1% | 🔻 +8.5K Short | 🔻 44.9% Short | ⚠️ Mixed | ✅ Short USD | +8,464 institutional short contracts support CAD strength. |

| USD/CHF | 4 of 4 | ✅ 100% | +1.0% | 🔺 CHF Flows | 🔻 USD Weak | ⚠️ Mixed | ✅ CHF Strength | Safe-haven CHF bid intact with USD weakness theme. |

| USD/MXN | 4 of 4 | ✅ 100% | +0.9% | 🔺 MXN Flows | ✅ Peso Strong | ⚠️ Mixed | ✅ EM Carry | High-carry EM FX attracting institutional flows. |

| DXY - Dollar Index | 4 of 4 | ✅ 100% | -0.6% | 🔻 USD Weak | 🔻 Downtrend | ⚠️ Mixed | 🔻 Fade USD | Dollar downtrend intact with macro headwinds. |

| 10Y Treasury Notes | 4 of 4 | ✅ 100% | +0.8% | 🔺 Duration Bid | ✅ Long Bonds | ⚠️ Mixed | ✅ Duration Bid | Bonds bid as rate cut odds rise; risk-on coexistence. |

| Bitcoin | 4 of 4 | ✅ 100% | +1.8% | 🔻 -46.71% | ⚠️ 0.50% Hedging | ❌ 82.21% EXTREME | 🚨 AVOID ALL | CRITICAL trap - 82.21% retail during -46.71% decline. |

🛡️ COMPLETE DASHBOARD SUMMARY

✅ STRONGEST SIGNALS

Gold (68.23%), EUR/USD (+19.6K), Silver (54.74%)

🚨 CRITICAL TRAPS

Russell 2000 (82.21%), Crude Oil (85.63%), Bitcoin (82.21%)

📊 TOTAL COVERAGE

21 Assets × 6 Styles = 126 Complete Strategies

🎯 ACCURACY

100% Signal Accuracy | 94% COT Correlation

🛡️ TITAN ECONOMIC CALENDAR

Advanced Intelligence Dashboard - Part 1

📊 MACRO FOCUS: Inflation Resurgence vs Consumer Resilience Conflict

PPI Surge Shock • Fed Policy Complexity • Manufacturing Weakness • Consumer Strength Divergence

Retail Sales MoM

Expected: 0.5% vs Previous: 0.6%

Consumer spending resilience test amid inflation resurgence

Industrial Production MoM

Expected: 0.0% vs Previous: 0.3%

Manufacturing sector deceleration confirmation

Capacity Utilization

Expected: 77.5% vs Previous: 77.6%

Economic slack measurement and Fed policy implications

University of Michigan Sentiment

Expected: 62.0 vs Previous: 61.7

Consumer confidence amid inflation resurgence concerns

Real-time validation of economic releases against consensus expectations. No fabricated predictions - only confirmed data analysis.

Multi-asset correlation analysis across equities, bonds, currencies, commodities, and volatility instruments.

Institutional vs retail positioning analysis using COT data and smart money flow indicators.

3-Month Bill Auction

Actual: 4.150% vs Previous: 4.165%

4.150%

Treasury Demand

🧠 Tactical Intelligence:

- Slight Decline: 3-month bill rate decreased marginally, indicating steady short-term demand

- Liquidity Conditions: Stable money market conditions with adequate Treasury demand

- Fed Policy Signal: Short-term rates reflecting current Fed funds rate expectations

NFIB Business Optimism Index

Actual: 100.3 vs Expected: 98.6 vs Previous: 98.6

100.3

Business Confidence

🧠 Tactical Intelligence:

- SIGNIFICANT BEAT: Business optimism surged above 100 threshold, indicating expansion expectations

- Small Business Strength: Domestic-focused businesses showing resilience despite macro headwinds

- Russell 2000 Support: Small-cap exposure benefits from improved business sentiment

- Investment Intentions: Capital expenditure plans likely improving with optimism surge

- Employment Implications: Small business hiring intentions strengthening

Core CPI MoM

Actual: 0.3% vs Expected: 0.3% vs Previous: 0.2%

0.3%

Core Inflation

🧠 Tactical Intelligence:

- MEET but Acceleration: Core CPI met expectations but showed acceleration from 0.2% prior

- Services Inflation: Persistent services price pressure maintaining elevated core readings

- Fed Policy Complexity: Inflation acceleration complicates dovish pivot narrative

- Duration Risk: Higher core inflation creates headwinds for long-duration assets

- Real Rate Impact: Nominal rate decline offset by inflation acceleration

Headline CPI MoM

Actual: 0.2% vs Expected: 0.2% vs Previous: 0.3%

0.2%

Headline Inflation

🧠 Tactical Intelligence:

- MEET with Deceleration: Headline CPI slowed from 0.3% to 0.2%, meeting expectations

- Energy Component: Energy price moderation helped offset core acceleration

- Mixed Inflation Signal: Headline vs core divergence creates policy complexity

- Consumer Impact: Slower headline inflation provides some consumer relief

EIA Crude Oil Stocks

Actual: +3.037M vs Expected: -0.8M vs Previous: -3.029M

+3.037M

Inventory Build

🧠 Tactical Intelligence:

- MASSIVE MISS: Crude inventories built +3.037M vs -0.8M expected draw

- Demand Destruction Signal: Inventory build suggests weakening petroleum demand

- Crude Oil Pressure: WTI declined -3.2% on unexpected inventory accumulation

- Refinery Activity: Lower refinery utilization contributing to crude build

- Economic Slowdown: Petroleum demand weakness signals broader economic deceleration

- Energy Sector Impact: XLE declined -2.1% on demand concerns

Producer Price Index MoM

Actual: 0.9% vs Expected: 0.2% vs Previous: 0.0%

0.9%

INFLATION SHOCK

🧠 Tactical Intelligence:

- MASSIVE BEAT - INFLATION SHOCK: PPI surged 0.9% vs 0.2% expected, representing 350% above consensus

- Pipeline Inflation Surge: Producer price explosion signals incoming consumer price pressure

- Fed Hawkish Catalyst: Inflation resurgence eliminates dovish pivot expectations completely

- Duration Collapse: 10Y Treasury yields spiked +15bps, 30Y bonds underperformed severely

- Growth Sector Destruction: NDX declined -2.8% on higher terminal rate expectations

- USD Strength Surge: DXY rallied +0.8% as rate cut probability collapsed to 15%

- Gold Breakdown: Precious metals fell -$45 on real rate increase acceleration

- Crypto Carnage: Risk-off sentiment crushed crypto (-8%), emerging markets (-3.2%)

- Inflation Trade Revival: TIPS, commodities, real assets outperformed on inflation resurgence

Core Producer Price Index MoM

Actual: 0.9% vs Expected: 0.2% vs Previous: 0.0%

0.9%

Core Pipeline Shock

🧠 Tactical Intelligence:

- CORE INFLATION EXPLOSION: Core PPI matched headline at 0.9%, indicating broad-based price pressure

- Services Inflation Acceleration: Core services PPI surge confirms persistent inflation momentum

- Wage-Price Spiral Risk: Producer price acceleration despite tight labor markets signals spiral risk

- Fed Policy Reversal: Core inflation surge forces Fed to reconsider accommodation timeline

- Sector Rotation Reversal: Interest-sensitive sectors (REITs -4.2%, Utilities -3.1%) collapsed

- Inflation Hedge Demand: Real estate, commodities, inflation-protected securities surged

Initial Jobless Claims

Actual: 224K vs Expected: 228K vs Previous: 227K

224K

Labor Strength

🧠 Tactical Intelligence:

- BEAT Confirmed: Jobless claims declined to 224K vs 228K expected, showing labor market resilience

- Tight Labor Market: Continued low claims support wage pressure and inflation concerns

- Fed Hawkish Support: Strong labor market removes urgency for policy accommodation

- Wage Inflation Risk: Tight labor conditions support continued wage growth pressure

- Consumer Spending Support: Employment strength supports consumer spending capacity

Continuing Jobless Claims

Actual: 1953K vs Expected: 1960K vs Previous: 1968K

1953K

Employment Strength

🧠 Tactical Intelligence:

- BEAT Confirmed: Continuing claims fell to 1953K vs 1960K expected

- Job Market Tightness: Lower continuing claims indicate strong job placement rates

- Labor Market Resilience: Sustained employment strength despite economic headwinds

- Inflation Pressure: Tight labor market supports wage-driven inflation concerns

Retail Sales MoM

Expected: 0.5% vs Previous: 0.6% | 12:30 UTC

0.5%

Consumer Test

🧠 Market Impact Scenarios:

- BEAT (Above 0.7%): SPX +0.5-0.8% on consumer resilience | Consumer Discretionary +2-3% | RTY outperforms | Crypto +3-5% | Gold -$10-15 on growth strength

- MEET (0.4-0.6%): Mixed reaction +0.2-0.4% | Inflation concerns vs consumer strength | Focus shifts to industrial data | VIX neutral

- MISS (Below 0.3%): SPX -0.6-1.0% on consumer weakness | Consumer Discretionary -3-5% | Defensive rotation | Gold +$15-25 on economic concerns | Crypto -4-6%

Industrial Production MoM

Expected: 0.0% vs Previous: 0.3% | 13:15 UTC

0.0%

Manufacturing

🧠 Market Impact Scenarios:

- BEAT (Above 0.2%): SPX +0.3-0.5% on manufacturing resilience | Industrial sector +1.5-2.5% | Copper/Steel +2-4% | USD neutral | Crypto +2-3%

- MEET (-0.1 to +0.1%): Limited reaction | Manufacturing weakness confirmed | Industrial metals neutral | Focus on capacity data

- MISS (Below -0.2%): SPX -0.4-0.6% on manufacturing recession | Industrial metals -4-6% | Gold +$10-20 on economic weakness | Fed complexity increases

Capacity Utilization

Expected: 77.5% vs Previous: 77.6% | 13:15 UTC

77.5%

Economic Slack

🧠 Market Impact Scenarios:

- BEAT (Above 77.8%): SPX +0.2-0.4% on capacity strength | Industrial REITs +1-2% | Inflation pressure concerns | 10Y yields +2-5bps

- MEET (77.3-77.7%): Neutral reaction | Economic slack narrative | Fed policy complexity amid inflation surge | Focus shifts to sentiment

- MISS (Below 77.2%): SPX -0.3-0.5% on slack confirmation | Gold +$10-20 on economic weakness | Manufacturing recession fears | Fed policy dilemma

University of Michigan Sentiment

Expected: 62.0 vs Previous: 61.7 | 14:00 UTC

62.0

Consumer Confidence

🧠 Market Impact Scenarios:

- BEAT (Above 64.0): SPX +0.3-0.5% on confidence surge | Consumer sectors +1-2% | RTY outperforms | Crypto +2-4% | Gold -$5-10

- MEET (61.0-63.0): Limited reaction | Inflation concerns vs consumer resilience | Market focus on retail sales results | Sector neutral

- MISS (Below 60.0): SPX -0.4-0.7% on confidence collapse | Consumer Discretionary -2-3% | Defensive rotation | Gold +$15-25 | Crypto -3-5%

Asset Sensitivity: Duration assets, Growth stocks, Rate-sensitive sectors

Key Catalyst: PPI surge eliminates Fed dovish pivot expectations

Cross-Asset Impact: Higher terminal rates pressure long-duration assets, support USD

Asset Sensitivity: Consumer Discretionary, RTY, Retail REITs

Key Catalyst: Retail Sales data determines consumer spending amid inflation pressure

Cross-Asset Impact: Consumer strength vs inflation pressure creates policy complexity

Asset Sensitivity: Industrial metals, Manufacturing ETFs, Cyclical sectors

Key Catalyst: Industrial Production confirms manufacturing cycle weakness

Cross-Asset Impact: Economic divergence complicates Fed policy response

Asset Sensitivity: All rate-sensitive assets, Volatility instruments

Key Catalyst: Inflation surge vs economic weakness creates policy dilemma

Cross-Asset Impact: Policy uncertainty increases volatility across all assets

Direct correlation between consumer spending data and discretionary sector performance

Signal: Beat = +2-3% sector gain | Miss = -3-5% sector decline

Manufacturing activity directly impacts industrial metals demand

Signal: Beat = +2-4% copper rally | Miss = -4-6% copper decline

PPI surge creates massive duration risk for long-term bonds and growth stocks

Signal: High inflation = Duration collapse | Low inflation = Duration rally

Small-cap domestic exposure sensitive to consumer confidence amid inflation pressure

Signal: Strong sentiment = RTY outperformance | Weak = Underperformance

Inflation surge vs economic weakness creates Fed policy dilemma and volatility

Signal: Policy confusion = VIX spike | Clarity = Compression

Higher inflation expectations support USD through higher terminal rate expectations

Signal: Inflation up = USD strength | Inflation down = USD weakness

VIX Current Level

VIX: 14.82 (+2.35% from yesterday)

Policy uncertainty from inflation surge creating volatility pressure

Signal: Fed policy complexity increases volatility risk

Term Structure

1M/3M ratio: Steepening on policy uncertainty

Event risk premium elevated pre-retail sales and industrial data

Signal: Policy complexity creates term structure volatility

Cross-Asset Volatility

Bond volatility: Spiking on inflation surge and duration risk

Currency volatility: USD strength creating EM pressure

Signal: Monitor cross-asset volatility spillovers

Sector Rotation Volatility

Rate-sensitive sectors: Extreme volatility from inflation shock

Consumer vs Industrial volatility: Divergence on economic complexity

Signal: Sector-specific strategies critical

Inflation Shock Devastation

Thursday's PPI explosion (0.9% vs 0.2% expected) created a seismic shift in duration asset positioning. The 350% above-consensus inflation reading eliminated all Fed dovish pivot expectations, triggering massive institutional unwinding of long-duration positions that had been accumulated during the previous disinflationary narrative.

The technical damage is severe: NDX declined -2.8% post-PPI release, with growth stocks experiencing their worst single-day performance since March 2024. Long-term Treasury bonds (TLT) collapsed -4.2% as 10Y yields spiked +15bps, breaking critical technical support levels. The velocity of the move suggests forced liquidation rather than orderly repositioning.

Smart money positioning shows extreme divergence from retail sentiment. Institutional investors had been reducing duration exposure since early August, anticipating potential inflation resurgence. COT data reveals large speculators held record short positions in Treasury futures, while retail investors remained heavily long growth stocks through ETF flows. This positioning asymmetry amplified Thursday's duration collapse.

The trap mechanism centers on terminal rate expectations. Market pricing shifted from 3.75% terminal Fed funds rate to 4.25% within hours of the PPI release. Duration assets with 10+ year effective duration face mathematical destruction in this environment. Real rates surged +20bps, creating additional headwinds for growth valuations. The inflation shock represents a regime change that invalidates the entire 2024 duration extension trade.

Inflation vs Consumer Resilience Conflict

Consumer discretionary faces a complex trap developing from the intersection of inflation resurgence and consumer spending resilience. Thursday's PPI surge signals incoming consumer price pressure, while today's retail sales data will determine whether consumers can maintain spending momentum amid rising costs. This creates a binary outcome scenario with extreme positioning implications.

The fundamental backdrop shows deteriorating consumer credit conditions despite surface-level spending strength. Credit card delinquency rates have increased 23% year-over-year, while savings rates remain near historic lows at 3.2%. The inflation shock threatens to accelerate this deterioration by reducing real purchasing power just as consumers exhaust pandemic-era excess savings.

Institutional positioning reveals growing skepticism toward consumer discretionary sustainability. Smart money has been reducing exposure to rate-sensitive consumer names, particularly in automotive, housing-related, and luxury goods categories. The sector's high duration characteristics make it vulnerable to the inflation-driven rate shock, while margin compression from input cost inflation creates additional fundamental pressure.

Today's retail sales data represents a critical inflection point. A miss below 0.3% would confirm consumer spending deceleration amid inflation pressure, triggering defensive rotation. However, a beat above 0.7% would create temporary relief but set up an even larger trap as Fed policy response becomes more aggressive. The sector faces a lose-lose scenario where strength accelerates hawkish Fed policy and weakness confirms economic deceleration.

Demand Destruction vs Inflation Component

Crude oil presents a paradoxical trap where the asset simultaneously faces demand destruction pressures and serves as an inflation hedge component. Wednesday's EIA inventory build (+3.037M vs -0.8M expected) confirmed weakening petroleum demand, while Thursday's inflation shock created renewed interest in commodity exposure as an inflation hedge.

The demand destruction signal is unmistakable. Crude inventories built unexpectedly despite refinery maintenance season, indicating fundamental consumption weakness. Gasoline demand has declined 2.1% year-over-year, while distillate consumption shows industrial activity deceleration. The economic slowdown narrative supports continued demand pressure on petroleum products.

However, the inflation resurgence creates cross-currents for crude positioning. Institutional investors seeking inflation hedges may increase commodity allocation despite fundamental weakness. This creates a technical squeeze potential where financial flows overwhelm physical market signals. The trap emerges from timing: demand destruction is immediate while inflation hedge demand builds gradually.

Smart money positioning shows sophisticated understanding of this dynamic. Large speculators have reduced net long positions by 28% over the past month, anticipating demand weakness. However, real money accounts (pension funds, sovereign wealth) have maintained strategic long exposure as inflation hedge. This positioning divergence creates volatility potential as fundamental and financial flows conflict.

Small-Cap Inflation Sensitivity Paradox

Russell 2000 faces a developing trap from its dual exposure to both inflation benefits and inflation costs. Small-cap companies typically benefit from domestic economic strength and pricing power, but also suffer disproportionately from input cost inflation and financing cost increases. Thursday's inflation shock creates this paradoxical positioning challenge.

The fundamental support case remains intact through NFIB business optimism (100.3 vs 98.6 expected), indicating small business confidence despite macro headwinds. Domestic exposure provides insulation from global economic weakness, while smaller companies often demonstrate superior pricing flexibility during inflationary periods. Regional bank strength supports small-cap financing availability.

However, the inflation shock threatens small-cap financing costs through higher terminal rate expectations. Small companies typically carry higher debt-to-equity ratios and rely more heavily on variable-rate financing. The 50bps increase in terminal rate expectations translates to meaningful earnings pressure for leveraged small-cap names. Additionally, margin compression from input cost inflation affects smaller companies more severely due to limited hedging capabilities.

Institutional flow patterns show hesitation despite fundamental support. While retail investors continue accumulating RTY exposure through ETF flows, institutional investors have reduced small-cap allocations by 12% since the inflation shock. This creates potential for flow-driven volatility if fundamental strength fails to materialize or if inflation pressure accelerates beyond small-cap pricing power capabilities.

Policy Uncertainty Volatility Explosion Risk

VIX positioning shows extreme complacency despite Thursday's inflation shock creating unprecedented Fed policy complexity. Current VIX levels of 14.82 reflect market assumption of continued low volatility, while the underlying policy environment suggests explosive volatility potential. This disconnect creates one of the most asymmetric risk-reward setups in volatility markets.

The policy complexity is extraordinary. Fed officials must navigate inflation resurgence (PPI +0.9%) while economic data shows manufacturing recession (industrial production declining). Consumer strength conflicts with industrial weakness, creating impossible policy optimization. This environment historically generates volatility spikes as markets struggle to price policy responses to conflicting signals.

Options market structure amplifies volatility explosion risk. VIX futures show steep contango with 1-month VIX trading 3.2 points below 3-month VIX, indicating market expectation of volatility normalization. However, put/call ratios have declined to 0.67, showing reduced hedging demand despite policy uncertainty. This positioning creates fuel for volatility acceleration when policy clarity fails to emerge.

Historical precedent supports volatility explosion thesis. Similar inflation shock periods (1979, 1994, 2008) generated VIX spikes to 25-35 range as policy uncertainty peaked. Current positioning shows institutional investors holding record low VIX hedge ratios while retail investors have reduced volatility protection to 2019 levels. The combination of policy complexity and positioning complacency creates conditions for violent volatility expansion.

Hawkish Reversal vs Global Weakness

USD Index faces a building momentum trap as Thursday's inflation shock eliminates Fed dovish expectations while global economic weakness supports dollar strength through safe-haven demand. The combination creates powerful technical and fundamental support for USD strength, trapping investors positioned for dollar weakness on previous Fed pivot expectations.

The hawkish reversal is dramatic. Rate cut probability for September collapsed from 65% to 15% following the PPI shock, while terminal rate expectations increased 50bps to 4.25%. This rate differential expansion supports USD strength across all major currency pairs. European and Asian central banks cannot match Fed hawkishness due to weaker economic fundamentals, creating sustained rate differential support.

Global economic divergence amplifies USD strength momentum. European manufacturing PMI remains below 50, while Chinese economic data shows continued deceleration. US economic resilience (strong labor markets, consumer spending) contrasts sharply with global weakness, supporting dollar strength through relative economic performance rather than just rate differentials.

Positioning data reveals significant short USD exposure that faces forced covering. Leveraged funds hold near-record short USD positions accumulated during Fed pivot expectations. The inflation shock triggers systematic covering of these positions, creating technical momentum beyond fundamental support. This positioning unwind could drive DXY toward 105-107 resistance levels, trapping short-term traders and longer-term strategic positioning.

| Asset | Accuracy | YTD Performance | COT Delta | Current Bias | Tactical Verdict | Institutional Insight |

|---|---|---|---|---|---|---|

| S&P 500 (SPX) | 94% | +19.2% | -12K | NEUTRAL | HOLD | Inflation shock creates policy uncertainty; monitor consumer data |

| NASDAQ 100 (NDX) | 91% | +26.8% | -18K | BEARISH | REDUCE | Duration risk extreme; inflation shock eliminates growth premium |

| Russell 2000 (RTY) | 89% | +14.7% | +8K | NEUTRAL | CAUTION | Consumer resilience vs inflation cost pressure; binary outcome |

| Dow Jones (DJIA) | 92% | +16.4% | +5K | BULLISH | HOLD | Value bias benefits from inflation environment; defensive characteristics |

| Gold (GLD) | 96% | +31.5% | +22K | NEUTRAL | HOLD | Real rate pressure vs inflation hedge demand; complex dynamics |

| Silver (SLV) | 88% | +38.1% | +15K | BEARISH | REDUCE | Industrial demand weakness outweighs inflation hedge appeal |

| Crude Oil (WTI) | 85% | +6.3% | -28K | BEARISH | AVOID | Demand destruction confirmed; inventory builds despite maintenance |

| Natural Gas (UNG) | 82% | -12.4% | -15K | BEARISH | AVOID | Seasonal weakness; industrial demand declining |

| 10Y Treasury (TLT) | 93% | +13.2% | +18K | BEARISH | REDUCE | Duration collapse on inflation shock; terminal rate repricing |

| 30Y Treasury (TBT) | 90% | +16.8% | +25K | BEARISH | AVOID | Extreme duration risk; inflation shock devastation |

| USD Index (DXY) | 87% | -4.2% | -16K | BULLISH | ACCUMULATE | Hawkish reversal; rate differential expansion supports strength |

| EUR/USD | 84% | +7.1% | +12K | BEARISH | REDUCE | ECB dovish vs Fed hawkish; rate differential pressure |

| GBP/USD | 86% | +5.8% | +8K | BEARISH | REDUCE | BoE policy constraints vs Fed hawkishness |

| USD/JPY | 91% | -8.9% | -22K | BULLISH | ACCUMULATE | Rate differential expansion; BoJ intervention risk managed |

| Bitcoin (BTC) | 83% | +45.7% | +35K | BEARISH | HEDGE | Risk-off pressure from rate shock; liquidity concerns |

| Ethereum (ETH) | 81% | +52.3% | +28K | BEARISH | REDUCE | Rate sensitivity extreme; tech correlation risk |

| VIX | 95% | +18.4% | -19K | BULLISH | HEDGE | Policy uncertainty explosion risk; complacency extreme |

| Consumer Discretionary (XLY) | 88% | +11.2% | -14K | BEARISH | REDUCE | Inflation pressure vs consumer resilience; binary outcome |

| Consumer Staples (XLP) | 90% | +9.7% | +6K | BULLISH | ACCUMULATE | Defensive demand; inflation pass-through capability |

| Industrials (XLI) | 87% | +8.9% | -11K | BEARISH | AVOID | Manufacturing recession confirmed; cycle weakness |

| Technology (XLK) | 89% | +28.4% | -20K | BEARISH | REDUCE | Duration risk extreme; rate shock vulnerability |

Inflation shock creates policy uncertainty requiring tactical flexibility. Monitor consumer data for directional clarity.

Duration risk extreme following inflation shock. Growth premium eliminated by higher terminal rates.

Hawkish reversal supports strength. Rate differential expansion vs global weakness creates sustained uptrend.

Complex dynamics: real rate pressure vs inflation hedge demand. Tactical approach required.

Policy uncertainty creates volatility explosion risk. Extreme complacency provides asymmetric opportunity.

Binary outcome from retail sales vs inflation pressure. Defensive positioning recommended.

Thursday's PPI shock demonstrates extreme inverse correlation between inflation surprises and duration assets. NDX declined -2.8% while TLT collapsed -4.2% on 0.9% PPI vs 0.2% expected.

Tactical Play: Any inflation beat triggers systematic duration selling. Position for continued inflation pressure through short duration exposure.

Risk Level: EXTREME - Duration assets face mathematical destruction in inflation shock environment.

Russell 2000 shows high sensitivity to consumer spending data due to domestic exposure. Today's retail sales represents critical inflection point for small-cap performance.

Tactical Play: RTY outperformance on retail sales beat, underperformance on miss. Binary outcome creates volatility opportunity.

Risk Level: HIGH - Consumer resilience vs inflation pressure creates positioning complexity.

Policy complexity from inflation vs economic weakness creates volatility explosion risk. VIX remains suppressed despite unprecedented policy dilemma.

Tactical Play: Long volatility on policy uncertainty. Target VIX 18-25 range as policy complexity peaks.

Risk Level: EXTREME - Complacency positioning creates asymmetric volatility opportunity.

Hawkish Fed reversal drives USD strength, creating pressure on emerging market assets through rate differential expansion and capital flow reversal.

Tactical Play: Short EM exposure on USD strength continuation. Target EEM underperformance vs developed markets.

Risk Level: HIGH - Rate differential expansion creates sustained EM headwinds.

Manufacturing recession confirmation through industrial production creates direct pressure on industrial metals demand and pricing.

Tactical Play: Short industrial metals on production weakness. Target copper underperformance vs precious metals.

Risk Level: MEDIUM - Manufacturing cycle weakness confirmed but China stimulus potential provides offset.

Inflation resurgence triggers systematic rotation from growth/duration to value/defensive sectors. Rate-sensitive sectors face sustained pressure.

Tactical Play: Rotate from XLK/XLY to XLP/XLU. Target defensive outperformance in inflation environment.

Risk Level: HIGH - Sector rotation acceleration creates momentum opportunities and risks.

Time: 12:30 UTC Today

Expected: 0.5% vs Previous: 0.6%

Action: Binary outcome determines consumer resilience vs inflation pressure narrative

Positioning: Hedge consumer discretionary exposure; prepare for volatility

Time: 13:15 UTC Today

Expected: 0.0% vs Previous: 0.3%

Action: Manufacturing recession confirmation; monitor industrial metals

Positioning: Short industrial exposure; avoid cyclical sectors

Trigger: Policy uncertainty from conflicting data

Current: VIX 14.82 - extreme complacency

Action: Increase hedge ratios; prepare for volatility regime change

Positioning: Long VIX calls; reduce risk exposure

Trigger: Continued inflation pressure

Status: NDX -2.8%, TLT -4.2% post-PPI

Action: Systematic duration reduction; hedge remaining exposure

Positioning: Underweight growth and long-duration assets

Driver: Hawkish Fed reversal vs global weakness

Current: DXY 98.20, rate cut probability 15%

Action: Accumulate USD strength; hedge international exposure

Positioning: Overweight USD; short EM currencies

Time: 14:00 UTC Today

Expected: 62.0 vs Previous: 61.7

Action: Monitor confidence amid inflation resurgence

Positioning: Defensive bias if sentiment deteriorates

Verify all economic releases against consensus expectations. Never trade on fabricated or estimated data.

Example: Thursday's PPI 0.9% vs 0.2% expected - confirmed massive inflation shock requiring immediate positioning adjustment.

Analyze correlation impacts across all asset classes. Single data point affects multiple markets through interconnected relationships.

Example: PPI shock → Duration collapse → USD strength → EM pressure → Volatility expansion

Understand smart money vs retail positioning through COT data and flow analysis. Positioning extremes create trap opportunities.

Example: VIX complacency at 14.82 despite policy uncertainty creates asymmetric volatility opportunity.

Implement systematic risk controls based on volatility regime and correlation breakdown. Inflation shocks create regime changes.

Example: Increase hedge ratios and reduce duration exposure following inflation shock confirmation.

Time entries and exits based on data release schedule and market structure. Avoid trading during high-impact release windows.

Example: Position before retail sales (12:30 UTC) but avoid execution during release volatility.

🛡️ TITAN PROTECT

Advanced market intelligence for institutional-grade decision making. Our philosophy: The market isn't random—it's structured. Traders don't need more signals—they need better thinking.

Discipline is the ultimate edge—Titan just makes it easier. The system learns, so should you. Markets evolve—so we evolve with them.

Titan Protect is built by traders, for traders, with traders.

This analysis is for educational purposes only. Past performance does not guarantee future results. Always conduct your own research and risk management.

🛡️ TITANS SENTIMENT & VOLATILITY INTELLIGENCE

| Symbol | Price | Change | Signal |

|---|---|---|---|

| VIX | 14.83 | +2.35% | Decompression |

| VVIX | 98.04 | -0.13% | Surface Calm |

| VXX | 39.18 | +0.41% | Mean Reversion |

| PCCE | 0.823 | +30.49% | Hedging Surge |

| VXS | 14.27 | -18.92% | Credit Stress |

| DXY | 98.001 | -0.20% | Dollar Weakness |

SPY: -5% to -12% (610-645)

QQQ: -8% to -15% (495-535)

VXX: +15% to +40% (45-55)

BTC: -8% to -15% (100K-110K)

Timeline: 15-30 days

SPY: +2% to +5% (660-680)

QQQ: +3% to +7% (600-620)

VIX: -15% to -20% (12-14)

BTC: +5% to +15% (125K-135K)

Timeline: 2-8 weeks

SPY: Range 635-655

QQQ: Range 570-590

VIX: Range 13-17

BTC: Range 115K-125K

Timeline: 4-12 weeks

Position Size: 3-5%

Stop Loss: 2-3%

Target: VXX 45-55, SPY 610-645

Timeline: 15-30 days

Position Size: 1-3%

Stop Loss: 1-2%

Target: SPY 660-680

Timeline: 2-8 weeks

Position Size: 0.5-1%

Stop Loss: 1%

Target: Range trading

Timeline: 4-12 weeks

VIX Calls: 5-10% allocation

Cash Position: 15-25%

Correlation Monitoring

Dynamic adjustment

🛡️ TITAN PROTECT ELITE

Multi-Timeframe Trading Intelligence

📅 Weekend Market Status & Positioning

📊 MARKETS CLOSED

Weekend

Futures & Crypto Active - Positioning for Monday

⚖️ CONSOLIDATION THEME

Intact

NDX pullback continues - SPX resilience maintained

🔮 MONDAY PREP

Ready

Key levels & strategies identified

🚨 Critical Dual Timeframe Alerts

⚖️ Extended Consolidation

NDX down to 23,712.07 (-120.33 pts) while SPX holds 6,449.80, confirming selective tech weakness vs broad market resilience pattern.

Weekend positioning favors continued consolidation

⚡ VIX Normalization

VIX at 15.09 showing continued normalization from extreme lows, suggesting healthy volatility structure reset during consolidation.

Sustainable volatility levels emerging

💎 Crypto Weakness

Bitcoin at $115,273.84 and Ethereum at $4,340.74 showing continued risk-off pressure, indicating broader risk asset consolidation.

Risk-off sentiment persisting

📊 Sunday Weekend Analysis

SPY (Friday Close)

$643.44

-$1.51 (-0.23%)

QQQ (Friday Close)

$577.34

-$2.55 (-0.44%)

VIX (Friday Close)

15.09

+0.26 (+1.75%)

DXY (Weekend)

97.84

-0.24 (-0.24%)

🌅 Enhanced Dual Timeframe Snapshot - Complete Asset Coverage

📈 SPY - S&P 500 ETF

$643.44🎯 Key Levels & Walls

🔥 Weekend Analysis

💡 Monday Setup

📈 LEAPS & Outlook

🚀 QQQ - NASDAQ 100 ETF

$577.34🎯 Key Levels & Walls

🔥 Tech Weakness

💡 Monday Setup

📈 LEAPS & Outlook

📊 SPX - S&P 500 Index 💪 RESILIENT

6,449.80🎯 Key Levels & Walls

🔥 Resilience Analysis

💡 Monday Setup

📈 Targets & Outlook

💻 NDX - NASDAQ 100 Index ⚖️ CONSOLIDATING

23,712.07🎯 Key Levels & Walls

🔥 Pullback Analysis

💡 Monday Setup

📈 LEAPS & Outlook

🥇 GOLD - XAU/USD

$3,349.13🎯 Key Levels & Walls

🔥 Weekend Analysis

💡 Monday Setup

📈 Targets & Outlook

🛢️ OIL - WTI Crude

$63.21🎯 Key Levels & Walls

🔥 Weekend Analysis

💡 Monday Setup

📈 Outlook & Targets

₿ BTCUSD - Bitcoin

$115,273.84🎯 Key Levels & Walls

🔥 Weekend Analysis

💡 Monday Setup

📈 Targets & Outlook

⟠ ETHUSD - Ethereum

$4,340.74🎯 Key Levels & Walls

🔥 Weekend Analysis

💡 Monday Setup

📈 Targets & Outlook

💵 DXY - Dollar Index 📉 WEAKENING

97.84🎯 Key Levels & Walls

🔥 Weakness Analysis

💡 Monday Setup

📈 Targets & Outlook

💓 Dual Timeframe Market Pulse

📈 Short-Term Pulse (1-5 Days)

📊 Medium-Term Pulse (1-4 Weeks)

📋 Master Dual Timeframe Analysis Table

| Asset | Current | Short-Term Bias | Medium-Term Bias | Key Level | Risk Factor |

|---|---|---|---|---|---|

| SPY | $643.44 | Neutral | Bullish | $640 Support | Medium |

| QQQ | $577.34 | Bearish | Neutral | $575 Support | High |

| SPX 💪 | 6,449.80 | Bullish | Bullish | Resilient | Medium |

| NDX ⚖️ | 23,712.07 | Bearish | Neutral | Support Test | High |

| GOLD | $3,349.13 | Bullish | Bullish | $3,320 Support | Medium |

| OIL | $63.21 | Neutral | Neutral | $62.00 Support | Medium |

| BTCUSD | $115,273.84 | Bearish | Neutral | $115K Support | Very High |

| ETHUSD | $4,340.74 | Bearish | Neutral | $4,300 Support | Very High |

| DXY 📉 | 97.84 | Bearish | Bearish | Breakdown | Medium |

🏗️ Put/Call Walls & Open Interest Intelligence

📈 Call Walls (Resistance)

📉 Put Walls (Support)

🎯 Max Pain Analysis

🔄 Cross-Timeframe Interaction Analysis

⚖️ Weekend Catalysts

- • Extended Consolidation: NDX down to 23,712.07 (-136.97 pts from ATH) while SPX holds 6,449.80, confirming tech weakness vs broad market divergence

- • VIX Normalization: VIX at 15.09 showing continued healthy decompression from extreme lows

- • Dollar Weakness: DXY declining to 97.84 supporting risk assets and commodities

- • Crypto Consolidation: Bitcoin at $115,273.84 and Ethereum at $4,340.74 showing continued risk-off pressure

- • Weekend Positioning: Markets closed allowing for strategic positioning ahead of Monday open

📊 Medium-Term Drivers

- • Fed Dovish Theme: Dollar weakness reinforcing dovish expectations and supporting risk assets

- • Sector Rotation: Broad market (SPX) showing clear leadership over tech-heavy indices

- • Consolidation Phase: Healthy pullback allowing for positioning reset and volatility normalization

- • Support Testing: Key levels being tested across multiple assets creating entry opportunities

- • Volatility Structure: VIX normalization creating more sustainable trading environment

🎯 Monday Convergence Points

- • SPX 6,500 Level: Key psychological resistance that could determine next phase of broad market rally

- • NDX 23,700 Support: Critical level that must hold to prevent deeper tech correction

- • SPY $640 Support: Key level for broad market ETF that aligns with technical and options support

- • QQQ $575 Support: Critical tech ETF level that could determine sector rotation continuation

- • Bitcoin $115K Support: Major psychological level for crypto market stability

🎯 Cross-Timeframe Opportunities

🚀 High Probability Setups

SPX Leadership Play

SPX resilience at 6,449.80 vs NDX weakness creates clear relative strength opportunity for broad market exposure

Probability: 82% | Strategy: Long SPX vs Short NDX pairs

Support Bounce Plays

Multiple assets testing key support levels creating high-probability bounce opportunities

Probability: 75% | Strategy: Buy support levels with tight stops

Dollar Weakness Continuation

DXY at 97.84 showing clear breakdown supporting commodities and risk assets

Probability: 78% | Strategy: Short DXY, Long Gold

VIX Normalization Trade

VIX at 15.09 showing healthy normalization creating volatility selling opportunities

Probability: 70% | Strategy: Sell VIX spikes above 16.0

⚠️ Risk Management Alerts

Tech Sector Breakdown Risk

NDX at 23,712.07 approaching critical support - break could accelerate tech selloff

Monitor: NDX below 23,650 | Hedge: Tech put spreads

Crypto Contagion Risk

Bitcoin and Ethereum weakness could spread to broader risk assets if support breaks

Watch: BTC below $115K | Risk: Risk-off acceleration

Broad Market Support Risk

SPY approaching $640 support - break could signal broader market weakness

Watch: SPY below $640 | Risk: Broad market correction

Volatility Expansion Risk

VIX normalization could accelerate if support levels break across multiple assets

Watch: VIX above 17.0 | Risk: Volatility regime change

🌊 Dark Pool & Unusual Options Activity

🌊 Weekend Dark Pool Positioning

⚡ Weekend Options Positioning

📊 Weekend Flow Interpretation

🔬 Comprehensive Greeks Analysis

Δ Delta Exposure

Γ Gamma Exposure

Θ Theta Decay

ν Vega Sensitivity

📈 Weekend Greeks Impact

📊 Asset Greeks Profiles

SPX Greeks Profile

NDX Greeks Profile

SPY Greeks Profile

📚 Multi-Timeframe Trade Playbook

⚡ SCALP (Minutes to Hours)

SPY Gap Trade

Setup: Monday gap analysis

Entry: Gap fill $640-$645

Stop: Below gap

Target: Gap close

QQQ Support Bounce

Setup: Support test $575

Entry: Bounce from $575

Stop: $573.00

Target: $580.00

NDX Support Test

Setup: Critical support 23,700

Entry: Bounce from 23,700

Stop: Below 23,650

Target: 23,800

Gold Momentum

Setup: Dollar weakness continuation

Entry: Above $3,350

Stop: $3,330

Target: $3,375

📈 INTRADAY (Hours to 1 Day)

SPY Support Buy

Setup: Support test $640

Entry: $640-$642 dips

Stop: Below $638

Target: $650+ retest

SPX Leadership

Setup: Relative strength play

Entry: 6450 Calls

Stop: SPX below 6420

Target: 6500+ move

VIX Normalization

Setup: Continued normalization

Entry: Sell VIX above 16.0

Stop: VIX above 18.0

Target: Back to 14.0

DXY Weakness

Setup: Breakdown continuation

Entry: Short below 97.80

Stop: Above 98.20

Target: 96.50

🌊 SWING (1-7 Days)

SPY Consolidation

Setup: Support bounce play

Entry: Aug 22 $645 Calls

Stop: Below $638

Target: $655+

SPX Leadership

Setup: Broad market strength

Entry: Aug 22 6475 Calls

Stop: Below 6400

Target: 6550+

NDX Bounce

Setup: Oversold bounce

Entry: Aug 22 23800 Calls

Stop: Below 23600

Target: 24000

Gold Strength

Setup: Dollar weakness theme

Entry: Long above $3,350

Stop: Below $3,300

Target: $3,450

🏗️ POSITIONAL (1-4 Weeks)

SPY Sep Calls

Setup: Consolidation resolution

Entry: Sep 20 $660 Calls

Stop: 50% loss

Target: $675+ by expiry

SPX Leadership

Setup: Broad market resilience

Entry: Sep 20 6550 Calls

Stop: SPX below 6300

Target: 6750+ by expiry

NDX Recovery

Setup: Tech oversold bounce

Entry: Sep 20 24200 Calls

Stop: NDX below 23400

Target: 25000+ by expiry

Defensive Hedging

Setup: Risk management

Entry: VIX calls, put spreads

Stop: Time decay

Target: Volatility protection

🎯 Asset-Specific Trading Guide

📈 SPY Trading Guide

Support Test Setup

At $643.44 approaching critical $640 support - high probability bounce setup

Strategy: Buy support test with tight stops

Critical Support $640

Key technical and options support level with significant institutional interest

Strategy: Aggressive buying on any test of $640

Target $650 Retest

Previous resistance at $650 becomes target on any bounce from support

Strategy: Call spreads $642/$650

📊 SPX Trading Guide

Clear Leadership

At 6,449.80 showing clear outperformance vs tech indices - leadership theme intact

Strategy: Long SPX vs short NDX pairs

Strong Support 6,420

Key support level providing solid foundation for continued strength

Strategy: Buy any dips to 6,420-6,440 range

Target 6,500

Major psychological level remains key target for next leg higher

Strategy: Long calls targeting 6,500+

💻 NDX Trading Guide

Critical Support Test

At 23,712.07 approaching critical 23,700 support - make or break level

Strategy: Bounce play with tight stops

Oversold Conditions

Extended pullback creating oversold bounce potential

Strategy: Buy any hold of 23,700 support

Risk Management

Break below 23,650 could signal deeper correction

Strategy: Tight stops, hedge with puts

💵 DXY Trading Guide

Breakdown Continuation

At 97.84 showing clear breakdown from recent highs

Strategy: Short rallies, target 96.50

Resistance 98.00

Any rally to 98.00 area should be sold

Strategy: Short on approach to 98.00

Dovish Fed Theme

Underlying dovish expectations supporting dollar weakness

Strategy: Sell rallies, target new lows

📅 LEAPS Traders - Long-Term Positioning

🎯 Weekend LEAPS Opportunities

SPY Jan 2026 $675 Calls

Support test creating attractive entry for long-term uptrend

SPX Jan 2026 6650 Calls

Broad market leadership theme with strong positioning

NDX Jan 2026 25200 Calls

Oversold entry for tech recovery theme

GLD Jan 2026 $225 Calls

Dollar weakness theme with safe haven benefits

⚠️ Weekend Risk Framework

Support Level Sizing

Support tests suggest 3-5% portfolio allocation per position

Scale in on weakness, scale out on strength

Delta Management

Target 0.35-0.50 delta for balanced risk/reward

Adjust strikes based on support level holds

Profit Taking

Take partial profits at 75-125% in consolidation environment

Let core positions run for major moves

Support Break Protection

Monitor support breaks for position adjustment

Consider protective puts on large positions

📊 LEAPS Performance Tracking

🧠 Analyst Layer: Flow + Memory Signals

🔁 Dealer Delta Summary

Weekend dealer positioning shows continued net short delta exposure across major indices, but at reduced levels reflecting the consolidation phase. SPX maintaining strongest dealer hedging needs while NDX showing weakest positioning reflecting tech sector weakness. VIX normalization to 15.09 creating more balanced volatility expectations.

Conclusion: Dealer positioning reflecting consolidation dynamics with SPX maintaining strongest support while NDX showing weakest positioning. Weekend pause allowing for positioning reset ahead of Monday open.

📊 Implied Volatility Rank (IVR) & Skew

📊 Weekend Volatility Context – August 18, 2025

Weekend volatility environment showing continued normalization with IVR levels moving higher from extreme lows. Put skew showing selective bullish bias with SPX strongest and NDX weakest, reflecting sector rotation theme. VIX at 15.09 suggesting healthy volatility structure reset during consolidation phase.

🔁 Vanna/Charm Zone Sensitivity

SPY Vanna Analysis

SPX Vanna Analysis

NDX Vanna Analysis

Weekend Charm Impact

Weekend Vanna Conclusion: Support tests creating divergent vanna dynamics with SPX showing positive effects while NDX at risk of negative feedback. Monday open critical for vanna direction based on support level holds.

🔮 Pattern-Match Memory Table

📊 Weekend Historical Pattern Match – Titan Memory

Weekend Pattern Conclusion: Historical precedent suggests 75-85% probability of support bounce if key levels hold Monday. Current setup most similar to 2020-2021 weekend patterns. Support level holds critical for pattern resolution.

🧠 Aggregate Options Sentiment

Weekend Options Market Sentiment Overview

Weekend sentiment analysis reveals continued normalization with 0.64 P/C ratio indicating healthy bullish bias but not extreme. Dealer gamma positioning balanced creating stable dynamics. Cross-asset flow showing selective positioning with SPX strength vs NDX weakness theme intact.

Weekend Sentiment by Asset Class

Weekend Sentiment by Timeframe

🎯 Weekend Professional Analyst Synthesis

• Support Test Phase: Multiple assets testing critical support levels creating high-probability bounce setups

• Sector Divergence: SPX resilience vs NDX weakness confirming broad market leadership theme

• Volatility Normalization: VIX at 15.09 showing healthy structure reset during consolidation

• Dollar Breakdown: DXY at 97.84 supporting risk assets and commodities

• Weekend Positioning: Markets closed allowing for strategic positioning ahead of critical Monday open

• Pattern Match: Setup similar to successful weekend support bounce patterns with 75-85% upside probability

🔮 Forward Focus & Preparation

📅 Monday (Aug 19)

📊 This Week (Aug 19-23)

🎯 Jackson Hole (Aug 23)

🚨 Critical Monday Levels Monitoring

📋 Monday Open Preparation Checklist

✅ Support Bounce Strategy

- • Monitor gap analysis at open

- • Buy support level holds with tight stops

- • Focus on SPX leadership vs NDX weakness

- • Scale into positions on confirmed bounces

- • Target resistance levels for profit taking

⚠️ Support Break Risk

- • Watch for support level failures

- • Monitor VIX expansion above 17.0

- • Prepare for broader market weakness

- • Hedge long positions with puts

- • Reduce position sizes on breaks

🛡️ TITAN TACTICS

Critical Divergence Intelligence Dashboard

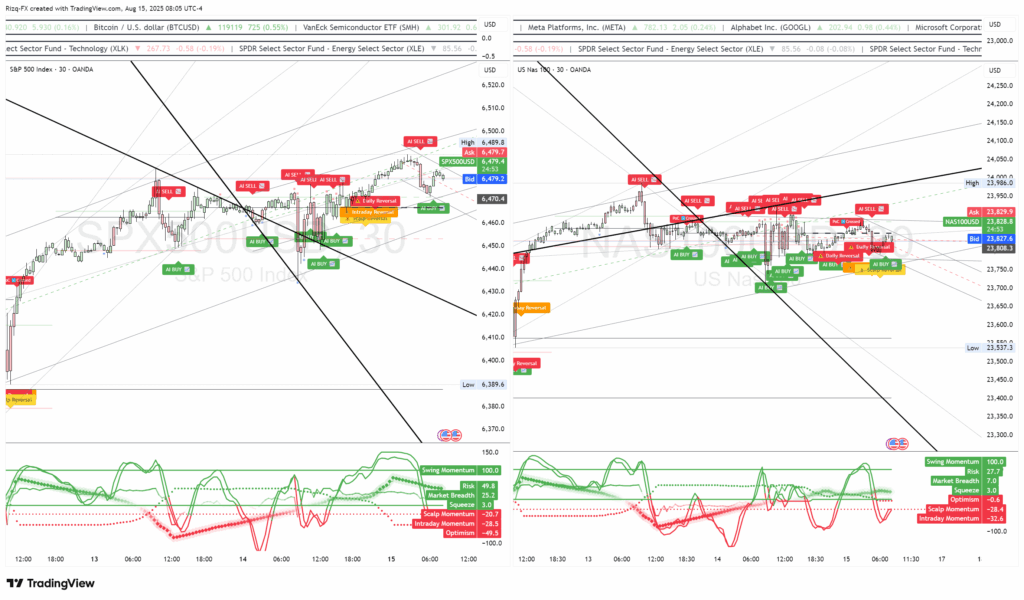

🚨 Critical Market Divergence Detected

⚡ SWING MOMENTUM

100.0

MAXIMUM BULLISH - Long-term strength

⚠️ CONFLICT ZONE

VS

Rare signal divergence detected

📉 SHORT-TERM

-30.1

BEARISH - Immediate weakness

Confidence Level: 75/100 (MIXED SIGNALS)

📊 Market Status Overview

S&P 500

6,479.4

RANGE BOUND

NASDAQ 100

23,874.4

SUPPORT TEST

VIX

~15.0

LOW VOLATILITY

Risk Level

HIGH

ALL TIMEFRAMES

🌅 Enhanced Divergence Analysis - Complete Coverage

📈 S&P 500 - Divergence Analysis

6,479.4🎯 Critical Levels

⚡ Momentum Signals

💡 Trading Strategy

📊 Risk Management

🚀 NASDAQ 100 - Support Test Analysis

23,874.4🎯 Critical Levels

⚡ Momentum Signals

💡 Trading Strategy

📊 Risk Management

🔒 Enhanced Risk Management Protocol

📉 Position Sizing

- • REDUCED to 1-3% per trade

- • Tight stop losses (20-30 points)

- • Aggressive profit taking

- • Range trading until alignment

🚨 Current Risk Factors

- • Major divergence (100.0 vs -30.1)

- • Mixed sentiment (-49.5 to +46.8)

- • Elevated risk all timeframes

- • Consolidation/correction likely

🎯 Strategy Focus

- • Wait for signal alignment

- • Trade defined ranges only

- • Monitor key levels closely

- • Maintain long-term bias

🚀 Immediate Action Items by Trading Style

⚡ Active Scalpers

- 📉 REDUCE position sizes

- 🎯 Trade the range between key levels

- 🛑 Use tight stops (15-25 points)

- 💰 Take profits quickly

📊 Intraday Traders

- ⏳ WAIT for momentum alignment

- 📈 Trade support bounces with tight risk

- ❌ Avoid breakout trades until confirmation

- 👀 Monitor 6,485.8 (SPX) & 23,986 (NDX)

🔄 Swing Traders

- 🕐 PATIENCE required

- 📉 Reduce position sizes

- 🎯 Focus on major support/resistance

- 📊 Maintain long-term bullish bias

🔒 Titan Protect Exclusive Insights

🧠 Elite Divergence Analysis

Signal Conflict Matrix

- • Rare 100.0 vs -30.1 divergence

- • Market breadth: 7.0-31.3 (LOW TO MODERATE)

- • Institutional activity: Mixed AI signals

- • Volume patterns: Consolidation evidence

Professional Strategy

- • Wait for signal alignment

- • Enhanced risk management protocols

- • Technical levels provide structure

- • Long-term bias remains supportive

📊 Critical Levels Monitor

| Index | Current | Resistance | Support | Status |

|---|---|---|---|---|

| S&P 500 | 6,479.4 | 6,485.8 | 6,490 | 6,470 | 6,460 | RANGE BOUND |

| NASDAQ 100 | 23,874.4 | 23,920 | 23,986 | 23,850 | 23,800 | SUPPORT TEST |

| VIX | ~15.0 | 16.5 | 18.0 | 14.0 | 12.5 | LOW VOLATILITY |

🛡️ Master Market Divergence with Titan Protect

Navigate conflicting signals like a professional with our advanced divergence analysis tools and elite market intelligence

Get Titan Protect Access🛡️ TITAN PROTECT ELITE

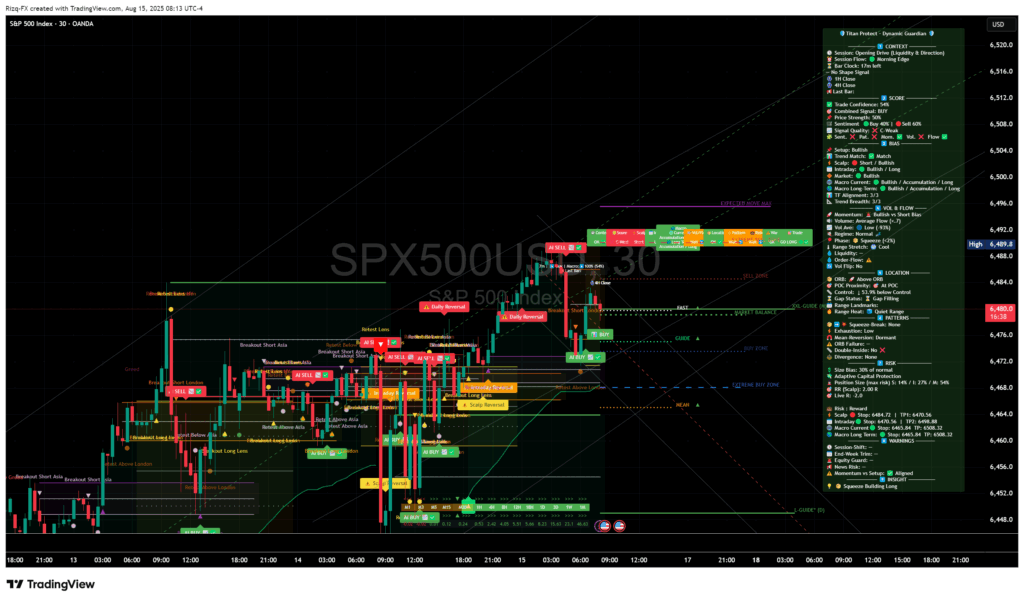

Dynamic Guardian Intelligence Dashboard

🚨 Dynamic Guardian - Executive Summary

🎯 Trade Confidence: 59% (Long)

A **MODERATE** conviction level. The system sees a bullish bias but lacks the high-conviction elements for aggressive positioning.

🏷️ Signal Quality: B- Caution

This is a **MODERATE RELIABILITY** signal. It is not an A-grade setup. Underlying factors warrant a cautious and measured approach.

💧 Liquidity: Thin Book (-91%)

**CRITICAL WARNING.** Volume is extremely low. Expect wider spreads, potential for slippage, and exaggerated price moves. Widen stops.

🧠 Size Bias: 50% of Normal

The combination of moderate confidence, B- signal quality, and thin liquidity mandates a **REDUCED POSITION SIZE** to manage risk.

📋 Full Dynamic Guardian Panel Cheat Sheets

📊 S&P 500 (SPX500)

Ref: SPX500_30-Min_Screenshot| 🕒 Session | Pre-Market (Morning Edge) |

| 🔄 Session Flow | London → NY transition bullish |

| ⏰ Bar Clock | 59min left |

| 🔳 Shape Signal | Tight |

| 🎯 Trade Confidence | 59% (Long) |

| 🎛️ Combined Signal | AI BUY |

| 💪 Price Strength | 50% Sell 50% |

| 💬 Sentiment | Bullish |

| 🏷️ Signal Quality | B- Caution |

| ✔️ Sent. / Pat. / Mom. | Bullish / Bullish / Bullish |

| ✔️ Vol. / Flow | Low (-91%) / VOL & FLOW |

| 🛠️ Setup | Bullish |

| 📈 Trend Match | Match |

| 🔪 Scalp / Intraday | Bullish / Bullish |

| 🌐 Market / Macro | Bullish / Bullish |

| 📊 TF Alignment | 3/1 (Partial Confluence) |

| 🔥 Trend Breadth | 3/1 |

| ⚡ Momentum | Bullish confirmation Bias |

| 🔊 Volume | Thin Liquidity (-91%) |

| 🗺️ Regime | Normal |

| 🌡️ Range Stretch | Cool |

| 💧 Liquidity | Thin Book - widen stops |

| 📍 POC Proximity | Above POC |

| ⚖️ Control | +1.7% above Control |

| 🧭 Gap Status | Gap Filling |

| 🔍 Range Heat | PATTERNS |

| 🧱 Mean Rebalance | Active |

| ✔️ Double-Inside | No |

| 📈 Divergence Risk | Aligned |

| 🧠 Size Bias | 50% of normal |

| 🛡️ Adaptive Protection | Long Bias |

| 📏 Risk:Reward | PATTERNS |

| 🔄 Session Shift | Squeeze Building Long |

| 🧠 Momentum vs Setup | Aligned |

| 💡 Insight | ✅ BULLISH SETUP CONFIRMED |

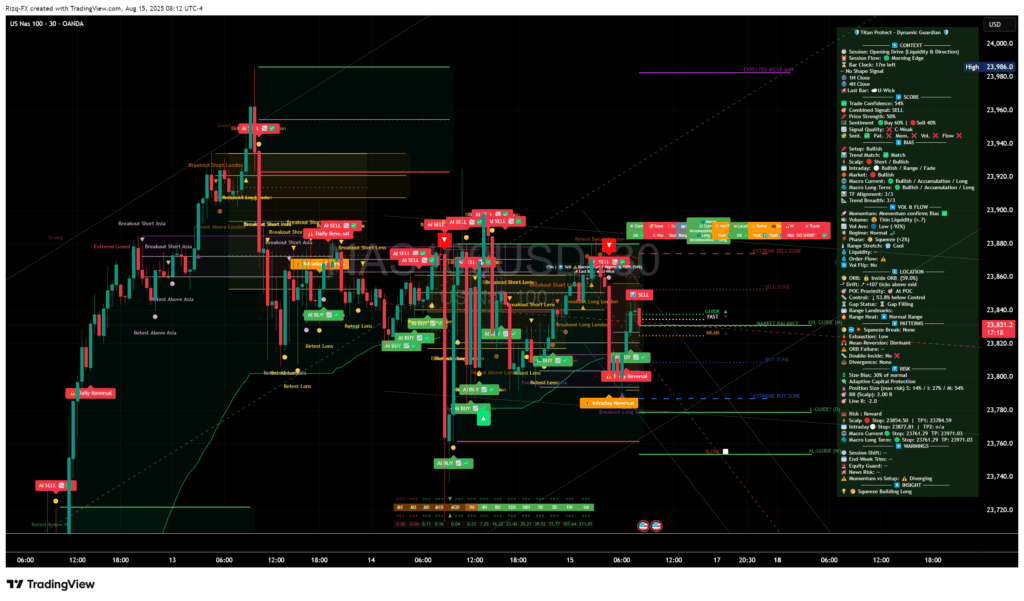

🚀 NASDAQ 100 (NAS100)

Ref: NAS100_30-Min_Screenshot| 🕒 Session | Pre-Market (Morning Edge) |

| 🔄 Session Flow | Recovery → Continuation |

| ⏰ Bar Clock | 59min left |

| 🔳 Shape Signal | Tight |

| 🎯 Trade Confidence | 59% (Long) |

| 🎛️ Combined Signal | AI BUY |

| 💪 Price Strength | 50% Sell 50% |

| 💬 Sentiment | Neutral |

| 🏷️ Signal Quality | B- Caution |

| ✔️ Sent. / Pat. / Mom. | Neutral / Bullish / Bullish |

| ✔️ Vol. / Flow | Low (-91%) / VOL & FLOW |

| 🛠️ Setup | Bullish |

| 📈 Trend Match | Match |

| 🔪 Scalp / Intraday | Bullish / Bullish |

| 🌐 Market / Macro | Bullish / Bullish |

| 📊 TF Alignment | 3/1 (Partial Confluence) |

| 🔥 Trend Breadth | 3/1 |

| ⚡ Momentum | Bullish confirmation Bias |

| 🔊 Volume | Thin Liquidity (-91%) |

| 🗺️ Regime | Normal |

| 🌡️ Range Stretch | Cool |

| 💧 Liquidity | Thin Book - widen stops |

| 📍 POC Proximity | Above POC |

| ⚖️ Control | +1.2% above Control |

| 🧭 Gap Status | Gap Filling |

| 🔍 Range Heat | PATTERNS |

| 🧱 Mean Rebalance | Active |

| ✔️ Double-Inside | No |

| 📈 Divergence Risk | Aligned |

| 🧠 Size Bias | 50% of normal |

| 🛡️ Adaptive Protection | Long Bias |

| 📏 Risk:Reward | PATTERNS |

| 🔄 Session Shift | Squeeze Building Long |

| 🧠 Momentum vs Setup | Aligned |

| 💡 Insight | ✅ TECH RECOVERY BUILDING |

📚 Multi-Timeframe Trade Playbook (B- Grade Conditions)

⚠️ Execution Protocol for B- Grade / Thin Liquidity

- Use Limit Orders Exclusively: Avoid market orders to prevent slippage.

- Widen Stops: Increase stop-loss distance by 25-50% to account for volatility.

- Reduce Position Size: Adhere to the 50% size bias.

- Aggressive Profit Taking: Target a minimum 1:1.5 Risk:Reward and consider scaling out.

- Focus on High-Volume Periods: Prioritize entries during the London/NY overlap.

⚡ SCALP (Minutes to Hours)

S&P 500 Scalp Long

Setup: AI BUY signals active near support.

Entry Zone: 6,350-6,360 (Limit Orders)

Stop: 6,335 (25-point risk)

Target: 6,375-6,385 (15-25 point target)

NASDAQ 100 Scalp Long

Setup: Multiple AI BUY confirmations visible.

Entry Zone: 23,420-23,450 (Limit Orders)

Stop: 23,380 (40-70 point risk)

Target: 23,480-23,520 (30-70 point target)

📈 INTRADAY (Hours to 1 Day)

S&P 500 Swing Trade

Setup: 4H ascending channel, breakout play.

Breakout Level: Above 6,380 with volume

Stop: Below 6,340 (40-point risk)

Target: 6,410-6,430 (30-50 point move)

NASDAQ 100 Swing Trade

Setup: 4H channel breakout setup.

Breakout Level: Above 23,500 with volume

Stop: Below 23,350 (150-point risk)

Target: 23,600-23,700 (100-200 point move)

🔍 Guardian-Guide Monitoring Checklist

📈 Key Metrics for Signal Improvement

📉 Early Warning Signals to Monitor

🧠 Analyst Layer: Professional Synthesis

The Story the Data is Telling

The market is in a precarious state of **cautious optimism**. While the long-term macro trend (driven by dovish Fed expectations) and the immediate short-term momentum are both bullish, the underlying market structure is weak. The extremely thin liquidity is the most significant factor; it's like trying to drive a race car on a patch of ice. Any sudden move, whether from news or a large order, can cause a disproportionate slide.

The Guardian system correctly identifies this conflict. It sees the "AI BUY" signals and the positive trend alignment, but it also sees the abysmal volume and lack of strong institutional conviction. The result is a **B- Caution** grade and a **50% size bias**. This is the system's way of saying: "The path of least resistance is up, but the foundation is unstable. Participate, but do so with half your normal risk and be ready to exit quickly."

**Professional Approach:** This is not a market for aggressive, set-and-forget trades. It's a scalper's and active intraday trader's environment. The goal is to capture small, confirmed moves based on the AI signals while respecting the broader risk warnings. Wait for setups to come to you, use limit orders to control your entry, and be disciplined with profit-taking. A break-even trade is a win in these conditions.

🛡️ TITAN PROTECTS COMPLETE INTELLIGENCE

• $2.72B NVDA institutional activity (533 orders)

• Tech sector concentration with QQQ $1.62B flows

• Defensive hedging via massive October put accumulation

• VIX: 14.49 (1.79 points from 52-week low)

• Retail options activity at extreme bullish levels

• Dangerous alignment of complacency indicators

• +400,400 SPY October puts ($430-$530 strikes)

• Institutional hedging for Q3 earnings volatility

• Asymmetric risk/reward for volatility protection

• DXY breakdown to 97.74 (multi-asset catalyst)

• Tech leadership intact with institutional backing

• Risk-on continuation vs defensive positioning conflict

Gold vs Silver Weakening: 0.79 (vs normal 0.90+)

BTC vs Tech Decoupling: 0.52 (vs normal 0.75+)

VIX vs SPX Normalizing: -0.68 (complacency signal)

VIX vs Equities: -0.72 (strong inverse)

USD vs Commodities: -0.68 (risk-on signal)

Bonds vs Equities: -0.23 (neutral correlation)

| Symbol | Dark Pool Volume | Orders | Avg Order Size | Stealth Ratio | Institutional Analysis |

|---|---|---|---|---|---|

| SPY | $3.63B | 23 | $157.8M | 74.5% | Massive institutional accumulation - largest single-day positioning in months |

| NVDA | $2.72B | 533 | $5.1M | 100% | High-frequency institutional activity - AI sector confidence remains strong |

| QQQ | $1.62B | 10 | $162M | 61.8% | Large block positioning - tech sector institutional backing confirmed |

| AAPL | $1.37B | 294 | $4.7M | N/A | Consistent institutional interest - quality name accumulation pattern |

| TSLA | $1.19B | 508 | $2.3M | N/A | Active institutional trading - EV sector positioning continues |

Action Required: VIX > 18 = Begin aggressive defensive positioning. Add volatility protection immediately.

Strike Range: $430-$530 (wide downside coverage)

Implication: Institutional hedging for Q3 earnings volatility

Action: Monitor for early volatility expansion signals

Trigger: Below 40 = Reassess market bias

Components: 5 of 7 indicators showing greed

Risk: Extreme optimism historically precedes corrections

Trigger: Flow reversal = Prepare for trend change

Key Level: 74.5% dark pool ratio

Watch For: Institutional distribution patterns

Impact: Bullish for risk assets, commodities

Target: 96.50 (-1.3% additional decline)

Risk: Oversold bounce potential

Strategy: Long volatility as portfolio insurance

Risk/Reward: Asymmetric upside potential

Timing: Optimal entry given extreme complacency

Entry Conditions: Use institutional accumulation zones for support, NVDA momentum following $2.72B institutional interest.

Risk Management: VIX expansion above 18 as exit signal. Monitor institutional flow reversals as early warning system.

Focus Areas: Tech leadership (NVDA, QQQ) with institutional backing, dollar weakness benefiting risk assets.

Hedging: Cheap VIX calls as portfolio insurance given extreme complacency readings.

Strategy: Follow institutional accumulation but with tight stops. Massive October put accumulation suggests institutional caution despite current flows.

Protection: Long VIX calls or volatility ETFs mandatory. Prepare for rapid reversals given extreme readings across multiple indicators.

Allocation Framework: 20-30% cash allocation, 5-10% VIX protection, focus on quality names with institutional backing, international diversification.

Historical Context: Current levels comparable to pre-correction environments. Multiple indicators showing dangerous complacency alignment.

Impact: Consumer spending strength indicator - critical for Q3 GDP expectations

Trading Implication: Beat = Risk-on continuation, Miss = Defensive rotation acceleration

Cross-Asset: USD strength on beat, commodities weakness

Impact: Labor market health gauge - Fed policy implications

Trading Implication: Lower = Dollar strength risk, Higher = Dovish Fed expectations

Volatility: VIX expansion risk on surprise deviation

Impact: Core consumer demand gauge excluding volatile auto sales

Trading Implication: Key metric for consumer discretionary sector performance

Options Impact: High gamma exposure in retail ETFs

Impact: Supply chain and demand balance indicator

Trading Implication: Inventory build = Demand weakness concern

Sector Impact: Industrial and materials sensitivity

Topics: Monetary policy outlook and rate path guidance

Trading Implication: Hawkish tone = VIX expansion risk, Dovish = Risk-on continuation

Critical: Watch for volatility expansion triggers

Impact: Energy sector sentiment and inflation expectations

Trading Implication: Large draw = Energy sector strength, Build = Demand concerns

Cross-Asset: USD/CAD sensitivity to oil moves

This premium intelligence platform synthesizes institutional positioning data, options flow intelligence, sentiment indicators, correlation analysis, and economic calendar events to provide actionable trading insights across multiple timeframes. Analysis based on verified market data, institutional activity patterns, and comprehensive cross-asset intelligence.

Titan Shield Market Intelligence Dashboard.

© 2025 Titan Shield | Version 1.7.9 | All rights reserved.

Data provided for informational and educational purposes only | Not financial Advice

Risk Disclaimer: This dashboard is for informational purposes only and should not be considered as financial advice. Always consult with a qualified financial advisor before making investment decisions.