✅ Titan Protect – Alpha Insights: Titan Lens Companion

🗓 15 May 2025

🔹 Instrument Set: Indices | Crypto | Commodities | Rates

🛡️ Signal Type: Cross-Asset Sentiment | Relief-Rally Pause

📊 Market Overview

• NASDAQ-100 (NAS100USD) – Printing 21 178.8, absorbing Tuesday’s thrust inside a tight intraday range.

• S&P 500 (SPX500USD) – Ticking around 5 860.4 after a mild pull-back; the breakout zone remains intact.

• Dow Jones (DJI) – Tracking 42 051.1, under-pinned by breadth in cyclicals.

• US Dollar Index (DXY) – Soft at 100.76, taking pressure off global liquidity.

📈 Rates & Credit

• US 10-year Yield – Has ratcheted up to 4.50 %, its highest in over a month. So far, equities are digesting the move, but every uptick tightens the discount-rate noose on growth valuations. A sustained push above 4.60 % would likely spark a pricing rethink—watch tech and high-beta for the first cracks. The curve keeps a gentle bull-steepening bias, signalling the move is supply- and term-premium-led rather than a sudden inflation scare.

• Volatility – VIX 19.16; futures 20.30. Compression continues, yet the first 2-point pop in VIX could flip sentiment quickly.

🪙 Crypto Insights

• BTC-USD – Coiling just above $102 000 after last week’s 7 % pop; structure remains constructive.

• ETH-USD – Firm at $2 559, maintaining relative strength on dips.

• Futures Basis – Still north of 7 % annualised, signalling healthy but not reckless leverage.

• Correlation Watch – Crypto beta to the Nasdaq stays elevated; equity-volatility moves will likely echo across digital assets.

🛢 Commodities Overview

• Gold Spot – Steady near $3 160 / oz despite higher yields—a tell that safe-haven demand is offsetting the rate head-wind.

• WTI Crude – Drifting around $63.5 / bbl; tariff détente is balanced by tepid demand data.

• Copper – Eases 1 % to $4.53 / lb on profit-taking, even as Chinese-stimulus chatter lingers.

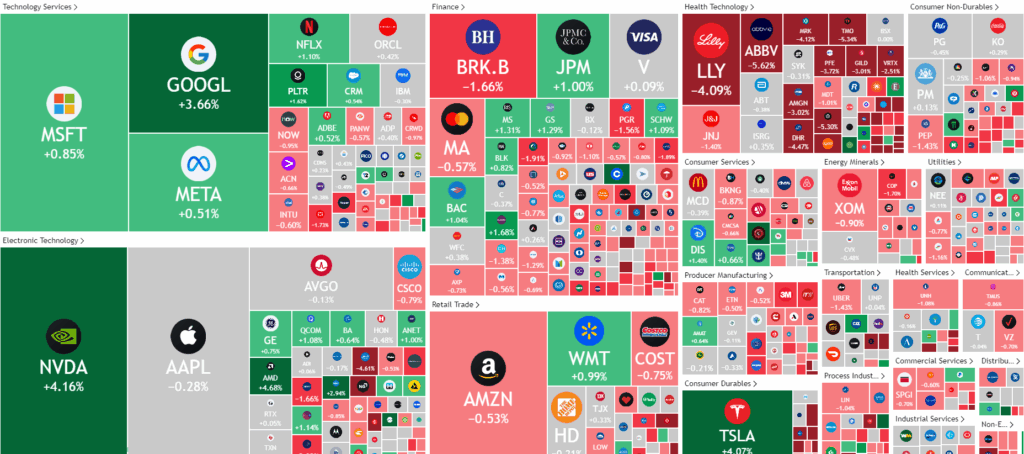

📌 Key Rotations / Sector Highlights

• Leaders: Semiconductors, discretionary retail, base-metals miners.

• Laggards: Utilities, staples, healthcare.

• Rotation Bias: Growth > Defensives; breadth is widening, but April’s peak participation has yet to return.

🔍 What I’m Watching

• Nasdaq 21 400 – A decisive break could ignite another squeeze; failure invites a swift mean-reversion fade.

• Yield Watch – If the 10-yr pierces 4.60 %, look for tech multiple compression and dollar firming.

• VIX Compression – Sub-20 vol seldom lasts; the first spike should reset the short-term tone.

• Crypto Divergence – Bitcoin holding > $101 k while equities pause would reinforce the medium-term bull case.

✅ Final Word

Momentum remains constructive, but rising long-end yields are the new swing factor. I’m bullish while volatility stays muted, yet ready to trim risk if the 10-yr yield pushes through 4.60 % or the Nasdaq stalls at resistance.

For information purposes only – not financial advice. This is how I’m framing today’s cross-asset landscape with the Titan Protect stack.