🛡️ Titan Tactics

SPX Breaks Out, NDX Lags — A Tale of Two Structures

📆 Tuesday, July 23, 2025 | ⏰ 23:59 BST / 18:59 EST

📦 Status: SPX Clears Resistance — NDX Still Coiled Below

🔭 MARKET OPENING

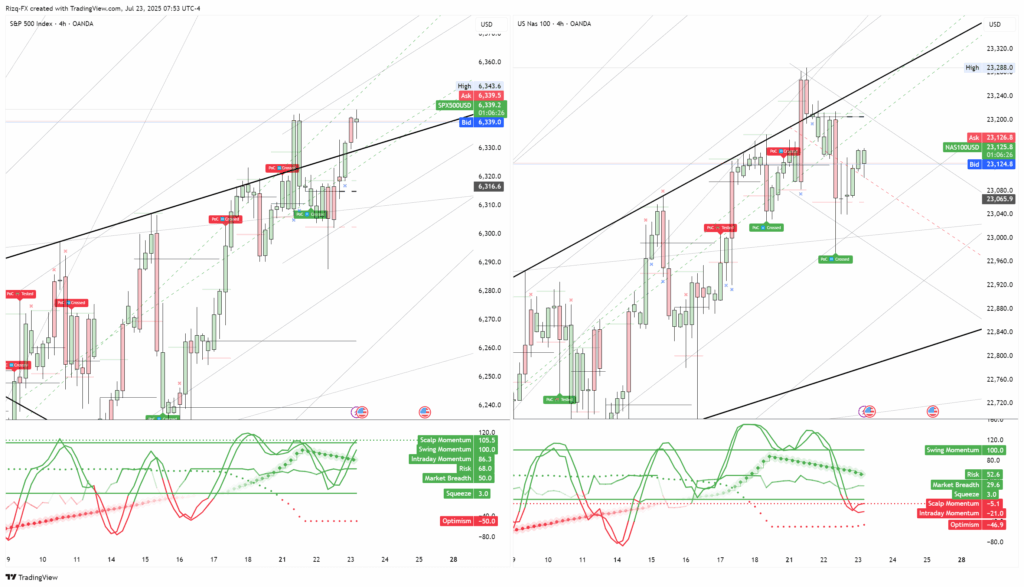

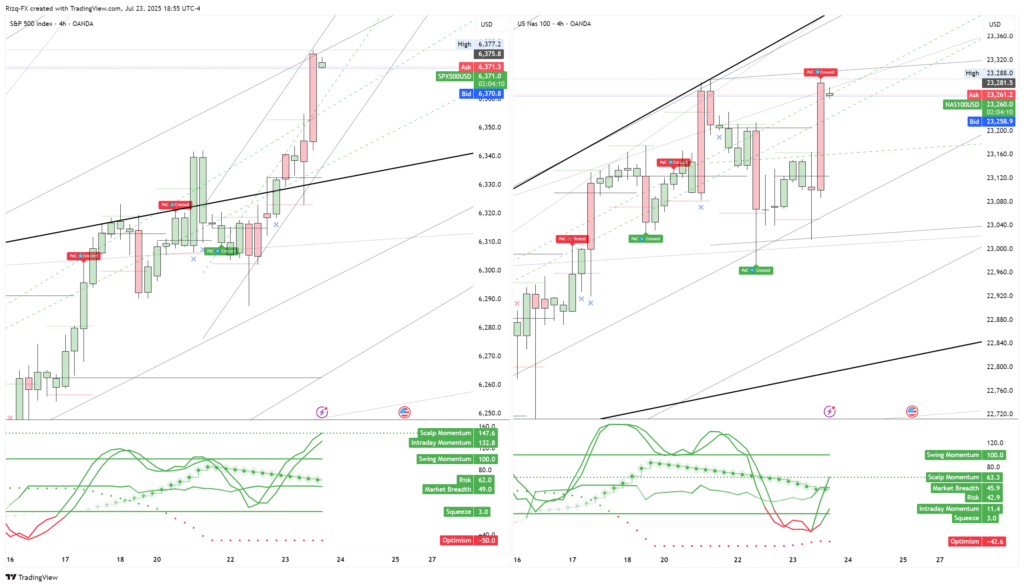

Two charts. Same timeframe. Different outcomes.

While the S&P500 (SPX) cleanly breaks structure and surges, the Nasdaq 100 (NDX) continues to coil under resistance — a visual divergence that speaks volumes about risk appetite and flow alignment.

Today’s updated 4H chart comparison (morning vs evening) highlights that SPX has completed a full breakout sequence, while NDX printed a rejection wick at diagonal resistance. That divergence may be subtle to the untrained eye — but for flow-aware traders, it’s everything.

STRUCTURED MARKET VIEW

Chart Comparison: Morning vs Evening (UTC-4)

📍 SPX (Left) | NDX (Right) — Both 4H

| Feature | 07:49 AM Snapshot | 18:55 PM Update |

|---|---|---|

| SPX Price | Sitting just under 6,340 diagonal cap | Clean breakout above 6,375 with momentum |

| NDX Price | Pressing into wedge resistance | Full-body rejection at 23,288 diagonal zone |

| SPX Momentum | ✅ Multi-TF aligned, but not extreme | ✅ Scalp 147.6, Intraday 132.8 = explosive |

| NDX Momentum | ❌ Negative to neutral intraday | ⚠️ Weak (Intraday 11.4, Optimism –42.6) |

| Pattern | Pre-break coil | SPX: Expansion / NDX: Trap |

📢 LEVELS & SETUPS — CHART-DRIVEN FLOW COMMENTARY

🟢 SPX500USD (S&P 500 Spot)

Confirmed breakout above major diagonal and prior local highs

Structure remains inside rising channel with possible magnet toward 6,400–6,420

Momentum stacking across all timeframes → potential for grind or continuation if 6,370 holds

No active reversal signals — trend intact

🧠 “This is a clean breakout – not a spike. Expect support on any pullbacks to the prior breakout zone (6,350–6,360).”

🔻 NAS100USD (Nasdaq 100 Spot)

Price rejected cleanly at the same resistance that SPX broke

Momentum shows a strong body, weak soul — candle large, but internals don’t confirm

Optimism and risk signals remain low; Scalp & Intraday momentum unaligned

Structure holding inside descending compression — false breakout trap risk active

🧠 “Unless NDX can hold 23,200+ and reclaim the diagonal decisively, this may unwind sharply.”

🔹 STRATEGIC OUTLOOK / RISK WINDOW

This is a pivotal divergence.

If SPX holds above its breakout level, momentum may drag NDX higher in sympathy — but only if tech responds to upcoming catalysts (e.g. PMI, Core PCE).

If NDX remains heavy, watch for rotation into value/cyclicals to continue, while SPX leads on structure alone.

A failure in SPX below 6,350 now becomes highly meaningful — it would confirm a false breakout and trigger downside flow compression.

🎯 Key Confirmation Zones:

SPX: Hold above 6,370 to stay bullish

NDX: Must reclaim 23,288 and close with flow/momentum aligned

Volatility: Still compressing — a breakout in either index could trigger a vol response

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

📉 Titan Tactics data reflects positioning as of July 23, 2025 (reported July 23, 2025)

✍️ Analyst: Titan Protect | Titan Tactics Division

⚠️ Educational content only. Not investment advice. Titan Protect does not offer financial services or broker recommendations.

📦 Archive Tag: TACTICSW3025 and TACTICS230725