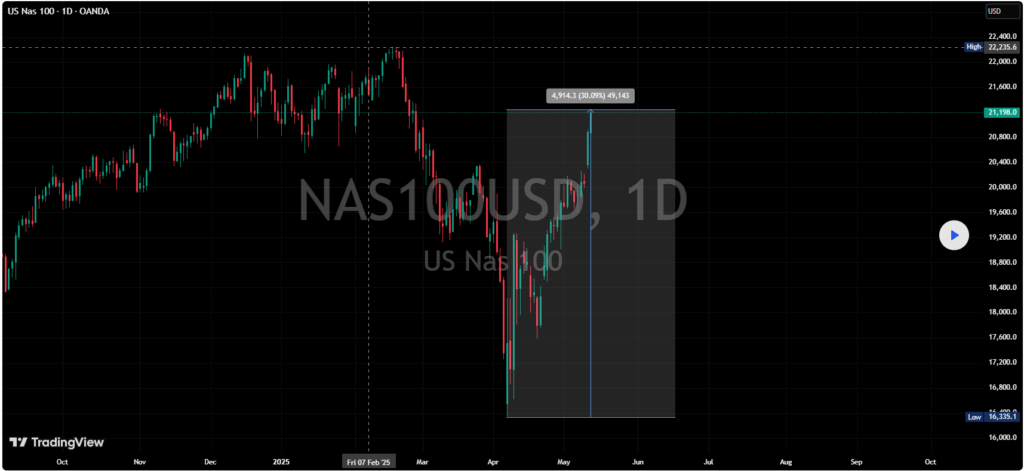

We’ve moved nearly 5,000 points from the April lows on NASDAQ, and over 1,000 points on the S&P 500. Yet despite that clear, tradeable move, many are still waiting — either for a crash that hasn’t come, or a runaway rally that already happened.

Let’s keep it simple:

Say you caught just 50–60% of the NASDAQ move. That’s 2,500 to 3,000+ points. If you layered in properly, shaved risk, locked profits, and rode the structure, that’s meaningful ground gained — not theoretical, not hindsight — just reactive, structured trading.

But here’s the friction point:

The hardest psychological shift isn’t finding entries. It’s accepting when:

- You’re wrong

- The market has changed

- It’s time to let go of a losing bias

Ask around, and you’ll hear it:

“I want it to drop because my TA says X”

or

“I need it to break even — I’m stuck in a position”

That’s not analysis. That’s hope. We always return to this principle:

Trade what’s happening, not what you want to happen. Take profits, not chances.

You don’t need the full move. You just need enough of it, often enough, with a process that protects your edge. The rest is just noise dressed up as conviction.