✅ Alpha Insights – Macro Flow Breakdown & Market Outlook

📅 Monday, June 30, 2025 | 15:30 PM GMT / 10:30 AM ET

🌐 Coverage: SPX | NDX | QQQ | SPY | DXY | BTC | Yields

🎯“Week of Rotations: Will Tech Hold the Line as Commodities and Bonds Signal a Bigger Shift?”

🧭 Executive Summary – What This Week Could Reveal About the Real Risk-On / Risk-Off Line in the Sand. (TL;DR for Scroll-Stoppers)

Indices: SPX and NASDAQ still in control, but VIX uptick suggests caution.

Gold & Silver: Quiet strength continues — major breakout watch.

Bitcoin: Softening – signs of liquidity rotation out of high-beta risk.

Dollar/Yields: Both pulling back – possible tailwinds for equities/metals.

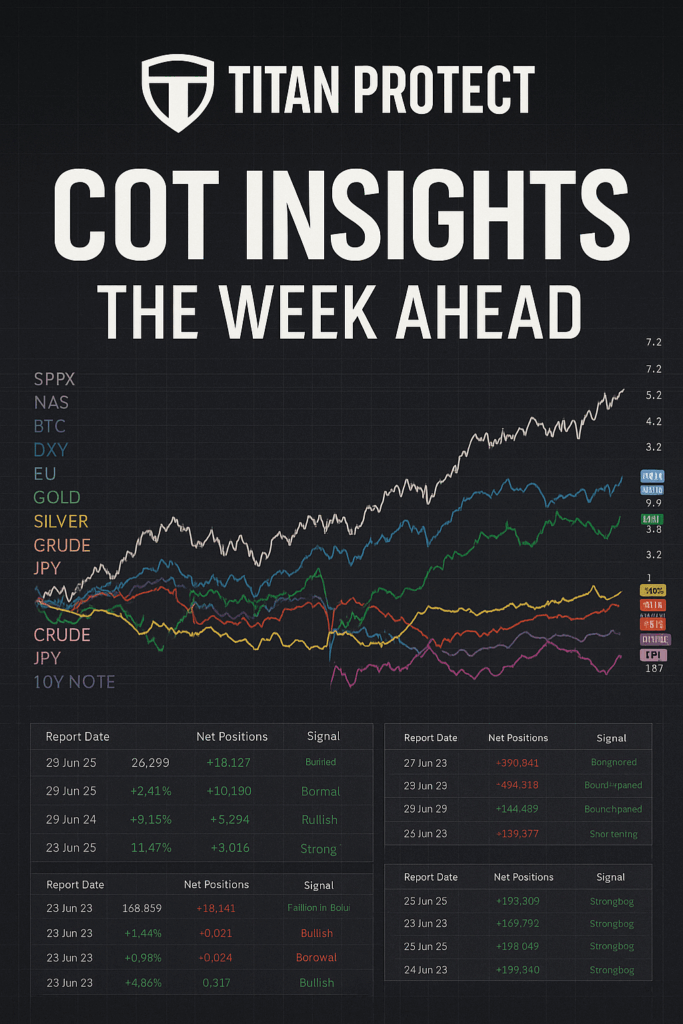

COT: Hedge funds increasing longs in metals, trimming crude — divergence setting up.

Flow Map: Positioning favors swing longs in equities and momentum plays in commodities.

🔍 Deep Breakdown by Asset Class

📈 Equity Indices:

SPX500USD:

Last: 6,194.4 (+0.29%)

Institutional positioning: +10K long increase (Asset Managers)

Retail: Still heavily short

Volatility: VIX rose +5.6%, showing hidden fear

📌 Expect: Buy dips, but tighten risk above 6,200. Look for possible shakeout pre-NFP.

NASDAQ / NDX:

Last: 22,642.3 (+0.40%)

Still outperforming. Tech megacaps supported.

Divergence vs. Dow and Russell → Macro flow still prefers high-beta names.

RUSSELL (RTY):

Underperformer. No real rotation seen into small caps.

Remains off limits for directional trades until confirmed breakout.

🪙 Crypto (BTCUSD):

Last: 107,544 (−0.77%)

Cooling off after strong June

Risk proxy status in decline

📌 Expect: Choppy price action. Avoid chasing. Reset zone is 105K–106K.

🟡 Gold & Silver:

Gold (XAUUSD): 3,286.6 (+0.35%)

Silver outperforming weekly again

COT: +5K net longs in Gold, +4K in Silver

USD and Yields both down = tailwind

📌 Expect: Quiet accumulation → Possible breakout by midweek if USD stays soft.

🛢️ Crude Oil (WTI):

Last: 66.12 (+0.28%)

COT: Slight trimming in longs

Still showing upward compression, but conviction fading

📌 Expect: Watch 67.50–68.00 for breakout/fakeout zone.

💱 FX & Dollar (DXY):

DXY: 97.254 (−0.10%)

COT: Net short maintained

EUR/USD & GBP/USD showing strength

📌 Expect: USD pullback may fuel risk-on asset plays + metals.

🧠 Smart Volatility Watch:

VIX: 17.25 (+5.63%)

Sign of hidden tension

Use as signal to reduce leverage in open trades midweek

📌 Expect: Short VIX trades not ideal here. Protect long equity exposures.

🎯 Strategic Flow Playbook

| Trade Type | Opportunity Zone |

|---|---|

| Scalp | Silver breakout, DXY fade, BTC short pops |

| Intraday | NAS100 longs, SPX rotational dip buys |

| Swing | Gold/QQQ/GLD/XLF holds |

| Options | VIX spreads, call verticals on GLD/SPY |

| CFD/Futures | Metals / Tech sectors remain core focus |

🧠 This Week’s COT-Backed Watchlist

📌 Strong Longs: SPX, NASDAQ, Gold, Silver

📌 Fading Conviction: BTC, Oil

📌 Bearish Bias: DXY, 10Y Bonds

📌 Neutralizing Assets: VIX (watch closely)

Information only – not investment advice. Powered by the Titan Protect macro stack.