🛡️ Titan Tactics

SPX Rejects, NDX Traps — Structure Break Fails to Hold

📆 Wednesday, July 30, 2025 | ⏰ 09:50 BST / 04:50 EST

📦 Status: Momentum Split + Trap Setup Active

🔭 MARKET STRUCTURE SNAPSHOT

Same charts. New posture.

After teasing breakouts, both SPX and NAS100 failed to sustain directional conviction. What looked like continuation is now clearly unwinding. The message from structure? Trap confirmed.

🔹 SPX rejected cleanly at its channel midpoint after a brief push above 6,390.

🔹 NASDAQ (NDX) showed early strength but posted a false breakout above 20,970 before rotating back into the compression wedge.

This is no longer “trend continuation” — this is a structure reversal watch.

📉 MOMENTUM BREAKDOWN — ASYMMETRY RETURNS

| Momentum Type | SPX500USD | NAS100USD |

|---|---|---|

| Swing Momentum | ✅ 100.0 | ✅ 100.0 |

| Intraday Momentum | 🔻 –44.8 (Bearish Unwind) | 🔸 20.6 (Neutral-to-Weak) |

| Scalp Momentum | 🔻 –48.8 (Red Flag) | 🔸 13.2 (Unstable Low) |

| Optimism Index | 🔻 13.8 → Weak Sentiment | 🔸 38.1 → Unclear Conviction |

| Risk Pressure | 🔻 –66.5 (SPX) | 🔻 –60.2 (NDX) |

🧠 Interpretation:

Momentum on SPX has flipped from aligned to aggressively unwinding. Meanwhile, NASDAQ is holding higher ground structurally — but without real conviction.

This kind of divergence is textbook false breakout into flow unwind.

🧭 STRUCTURAL LEVELS TO WATCH

🔺 NASDAQ 100 (NAS100USD)

Reclaim Zone (Long Bias): 20,910+

Breakdown Trigger (Short Bias): 20,670 flush

Trap Confirmation: 20,900–20,970 (wick trap zone)

Risk Floor: 20,480

🧠 “Failure to reclaim above 20,910 confirms the early-session trap and opens a path to 20,480 zone retest.”

🔻 S&P 500 (SPX500USD)

Reclaim Zone (Long Bias): 6,390+

Short Trigger: Breakdown below 6,325 → 6,288

Compression Band: 6,325–6,390

Reversal Trigger: Confirmed loss of 6,288

🧠 “SPX failed to build on its breakout. Clean rejection from midpoint confirms a lower high forming.”

🧠 STRATEGIC OUTLOOK — WHAT THE CHART IS REALLY SAYING

This isn’t weakness yet. But it is fragility.

SPX is leading the rejection — momentum has turned down with force

NDX has printed a false breakout trap — but hasn’t flushed (yet)

If both confirm breakdown below the 6,325 and 20,670 levels, this transitions into a broad short setup

💡 Trap + Compression = Flow Reversal Risk

Traders should now monitor:

→ Risk-off positioning accelerations

→ Whether NDX respects trap zone or flushes back into the wedge

→ Whether SPX can reclaim midpoint or rolls to 6,288

📌 CONFLUENCE SIGNALS ACTIVE

SPX: Channel midpoint rejection + lower high + negative intraday/short-term momentum

NDX: False breakout + trap wick + RSI/momentum misalignment

Titan Panel: Mixed HTF flow → short-term bias tightening

📢 “Price is whispering reversal — but waiting for confirmation.”

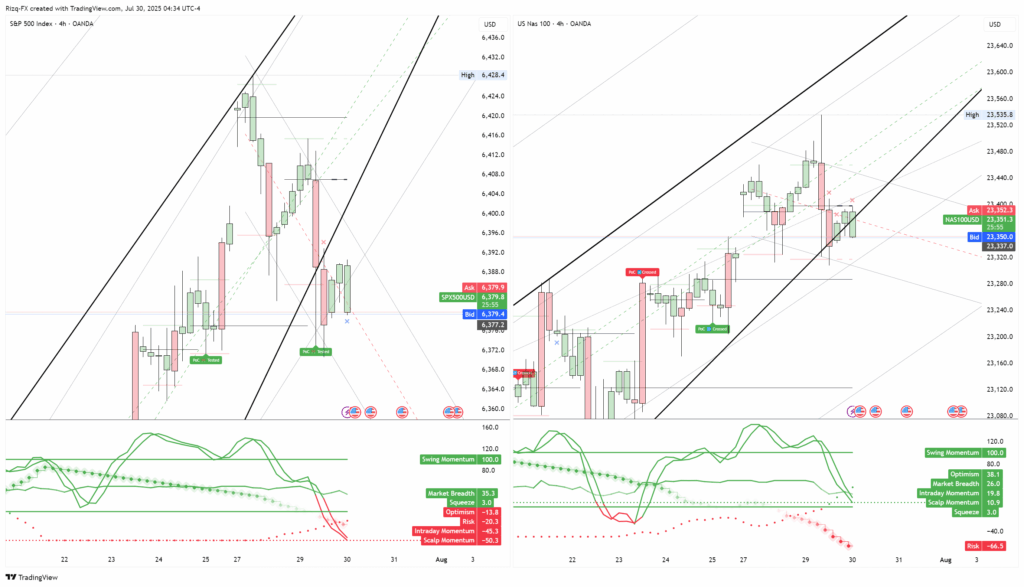

🖼️ VISUAL CONTEXT – CHARTS INCLUDED

Feature Image:

✅ SPX vs NASDAQ Side-by-Side 4H Chart (23:39 UTC-4 Snapshot)

→ Captures key rejection structure and momentum divergence

Additional Charts:

• NDX Wedge Trap Highlight (1H)

• SPX Compression + Momentum Flip (1H & 4H combo)

🎯 FINAL TAKE

This is not the breakout you’re looking for.

Momentum has diverged. Structures have rejected. Traps are set.

The edge now lies in confirmation and confluence — watch SPX 6,325 and NASDAQ 20,670 for decisive action. Until then, the burden is on the bulls to prove this isn’t a failed push.

Stay focused. Let structure lead.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

📉 Titan Tactics data reflects positioning as of July 30, 2025 (reported July 30, 2025)

✍️ Analyst: Titan Protect | Titan Tactics Division

⚠️ Educational content only. Not investment advice. Titan Protect does not offer financial services or broker recommendations.