✅ Titan Protect – Alpha Insights

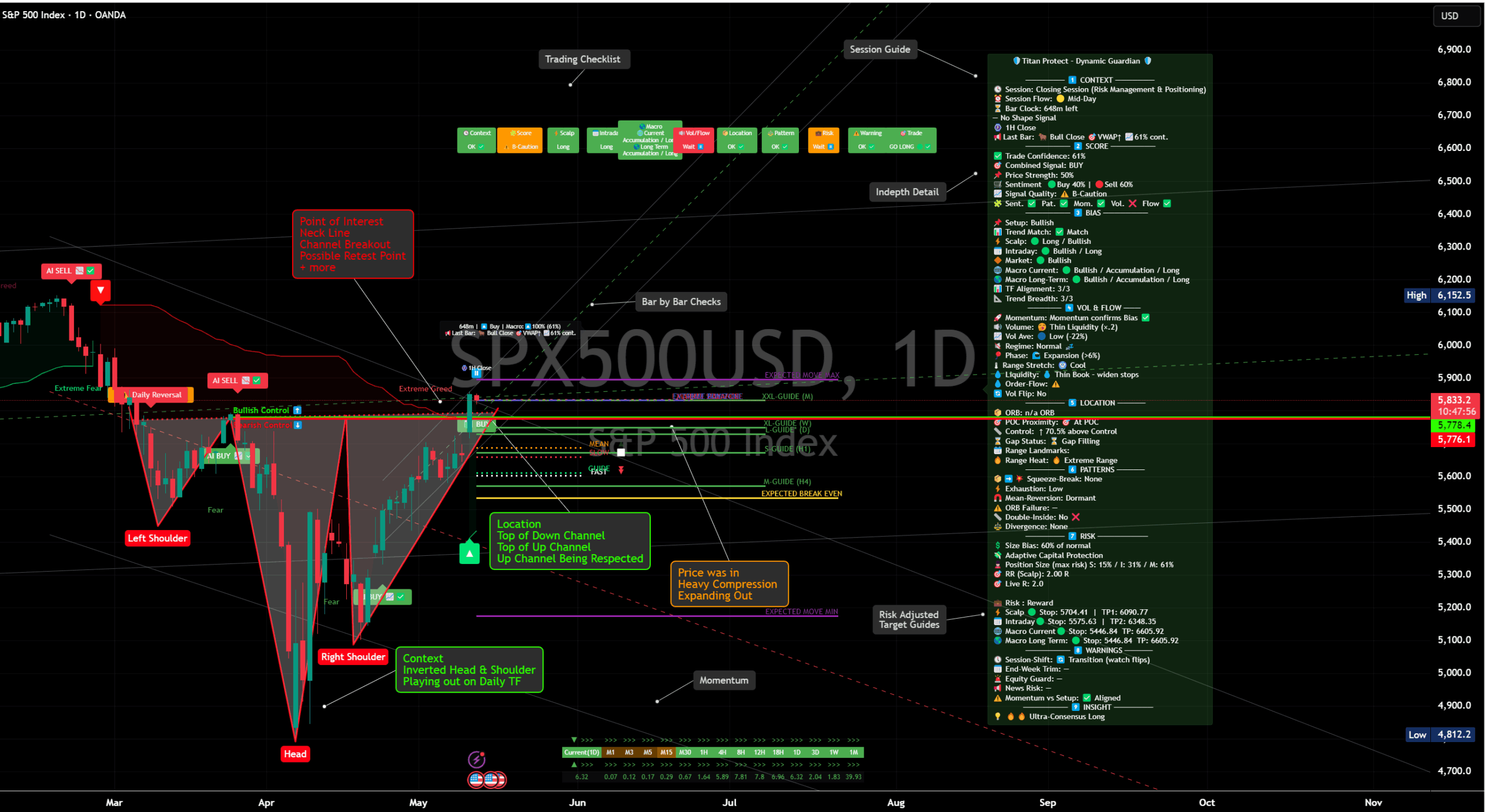

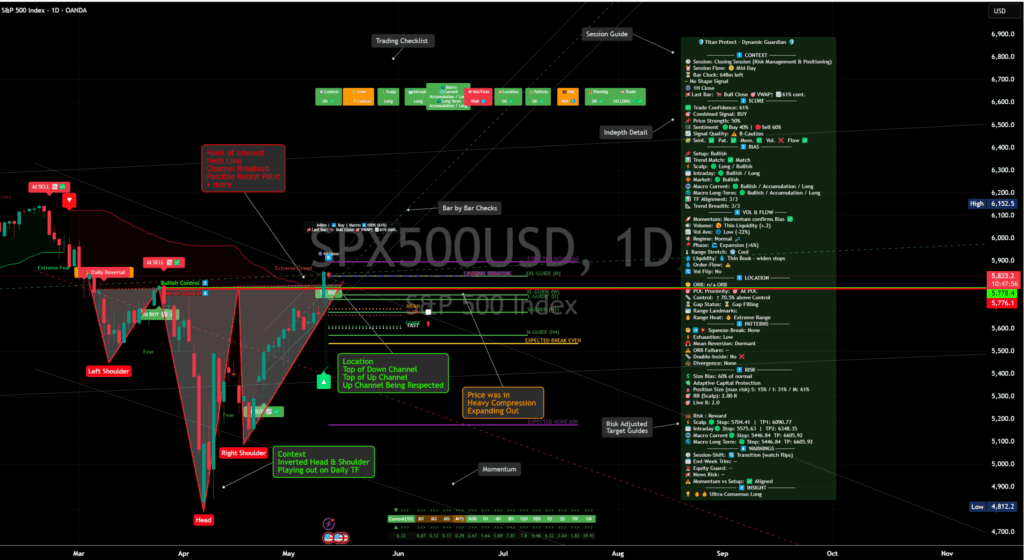

🔹 Instrument: $SPX500USD

🛡️ Signal Type: Post‑neckline breakout | Compression expanding

The S&P continues to stride above the inverted head‑and‑shoulders neckline (~5 833) and the up‑channel’s top rail. Momentum is aligned, but liquidity is thin, so every dip still looks like a surgical retest rather than a short trigger.

🔍 Supporting Titan Indicator References

• Trend Alignment: Bullish across all three tracked time‑frames (3 / 3)

• Sentiment Gauge: ✅ Ultra‑Consensus Long (internal split ≈ 40 % Buy / 60 % Sell)

• Macro Score: 61 % bullish‑accumulation bias

• Volatility Matrix: Phase C expansion after heavy compression

• Titan Guide Lines: Price hugging FAST & MEAN, well above SLOW; VWAP reclaimed with 61 % continuation odds

• Checklist: Momentum ✓ | Pattern ✓ | Volume ✕ (thin) | Flow ✓ — tagged “A‑Caution” quality

📌 Quick Setup Snapshot

• Breakout Trigger: 5 833+ confirmed and retested

• Immediate Support Zone: 5 765 – 5 780 (top of prior compression box)

• Invalidation: Sustained trade under 5 700 or VWAP lost on a close

• Scalp Bias: Long above 5 800; respect thin depth — fast exits if momentum stalls

• Core Positioning: Longs sized to ~60 % normal with staggered stops:

– Scalp stop 5 704 / TP 6 090

– Intraday stop 5 575 / TP 6 348

– Macro stop 5 446 / TP 6 606

🧠 Titan Summary Breakdown

🧭 Market Overview: VIX compressed, DXY drifting; backdrop keeps risk‑on doors open, but it’s CPI day at 08:30 ET — expect a volatility pulse into and immediately after the print.

💡 Sector Flow: Semis and discretionary lead; industrials picking up; defensives sidelined.

🎯 Price Action: Textbook inverted H&S is playing out; range heat “Extreme” yet stretch still “Cool”, suggesting upside headroom if CPI doesn’t derail the move.

🔍 What I’m Seeing: Structure, momentum, and flow all align bullish; volume is the single yellow flag. Plan is to buy controlled pull‑backs and peel gains into 6 090 and 6 348 without getting caught in the CPI spike.

🌐 Macro View: April CPI drops this morning. Consensus is 0.3 % MoM; anything hotter threatens to knock the breakout back to the neckline, while a cool print could catapult price toward 6 100 quickly. I’m keeping risk adaptive until the number lands, then letting Titan Guide Bands steer the post‑data trade.

✅ Final Word

Breakout stands, but today’s CPI can make or break the next leg. I’m long, stops are tight, and I’ll let the data decide whether to press or to hit the eject button. Trade your plan, not the headline.

This is not financial advice — just how I’m managing my own book with Titan Protect.