✅ Titan Protect – Alpha Insights – Daily Snapshot

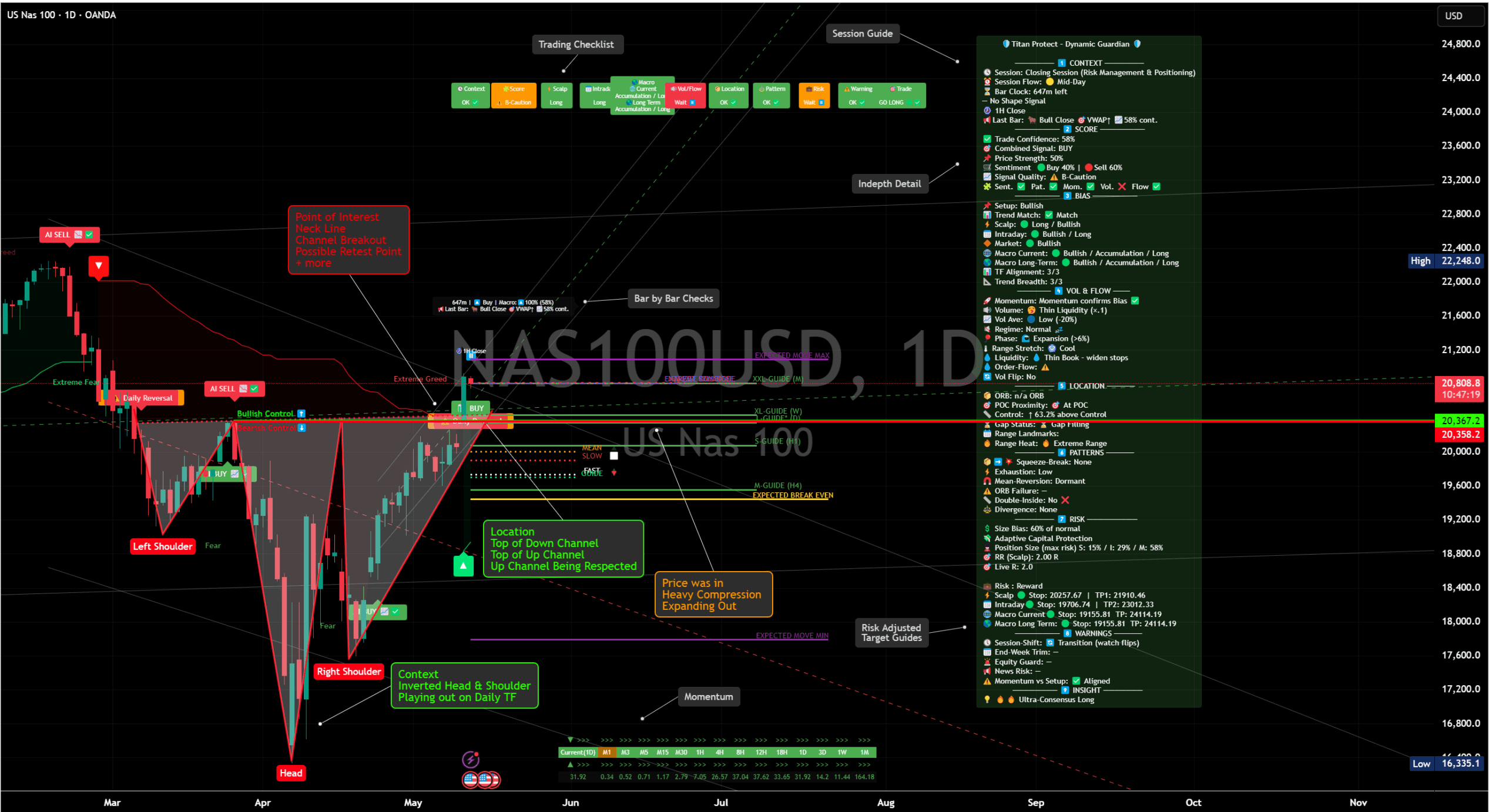

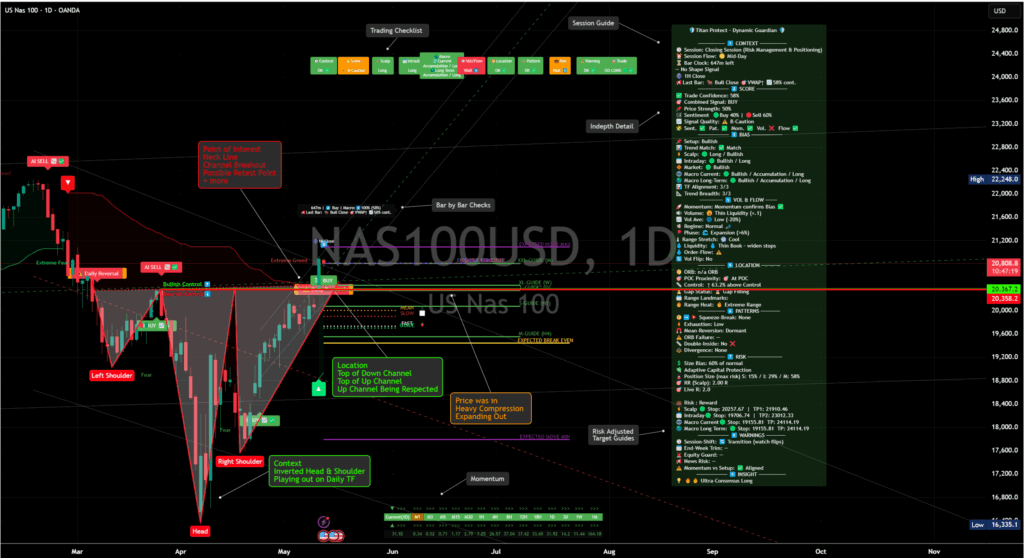

🔹 Instrument: $NAS100USD

🛡️ Signal Type: Neck‑line Breakout & Retest | Inverted H&S Confirmed

Price has punched through the daily inverted head‑and‑shoulders neck‑line and the upper rail of the two‑month compression channel. We’re now rotating back into the 20 360 – 20 400 zone (POC / gap‑fill) for a textbook retest while the rising trend‑line from the April “head” low continues to hold.

🔍 Supporting Titan Indicator References

• Trend Alignment: Bullish across all three tracked time‑frames (3 / 3)

• Sentiment Gauge: ✅ 58 % Buy bias (flow split 40 % long / 60 % short)

• Macro Score: ⚙️ 63 % — constructive but not maxed

• Volatility Matrix: Expansion phase (> 6 %) yet overall vol avg sits ≈ 20 % below norm → “stealth breakout” vibe

• Titan Guide Lines: Price hugging the MEAN guide after overshooting FAST; well above SLOW support at 19 700s

• Checklist: Mostly green — only ⚠️ is thin liquidity & sentiment split

📌 Quick Setup Snapshot

• Breakout Trigger: A daily close above 20 805 re‑ignites momentum

• Compression Floor: 20 360 down to the round 20 000 handle

• Invalidation Zone: Daily close back under 19 700 flips bias neutral‑to‑short

• Scalp Bias: Long on holds above POC; will only lean short if we lose 20 000 and momentum flips red

• Core Positioning: Starter longs on from breakout; stops trailed to 20 253 (scalp) and 19 702 (swing); targets scale 21 905 then 23 000 +

🧠 Titan Summary Breakdown

🗓️ Event Watch – US CPI prints today at 08 : 30 ET. Expect a volatility spike across indices, USD and rates. Position sizes trimmed to 60 % ahead of the release.

🧭 Market Overview – Risk‑on tone intact: VIX in the 12s, DXY firm but not derailing growth, and yields steady. Compression across assets hints at a larger directional move post‑CPI.

💡 Sector Flow – Semiconductors & big‑tech lead; discretionary improves, defensives fade — supports bullish bias.

🎯 Price Action – NAS100 respecting rising internal channel and testing neck‑line from above. Momentum ticks green, breadth 3 / 3 strong, but volume remains thin — suggests strong hands, not broad participation.

🔍 What I’m Seeing – Heavy compression resolved higher, first retest in play. If bulls defend 20 360 – 20 000 we could see a measured‑move push toward 21 900. Failure flips to false break with room back to mid‑19 k.

🌐 Macro View – CPI today is the key catalyst:

• Cool print (< consensus) → fuels next impulse, targets 21 900+

• Hot print (> consensus) → quick test of 20 000 / 19 700 invalidation zone likely

✅ Final Word

“Event risk first, trading second.” The retest area is attractive, but I’m letting CPI confirm direction before adding size. Will pyramid into strength on a hold above 20 805 or fade weakness only after a daily close below 19 700.

Not financial advice — just how I’m managing my own book with Titan Protect.