🧾 What Are Options?

A Simple, Smart Introduction for New Traders

If you’re new to trading, you’ve probably heard the term “options” — and maybe felt a bit intimidated.

Calls, puts, premiums, greeks, expiration…

It sounds complex, and many avoid it.

But at its core, options are simply contracts that give traders more flexibility, leverage, and risk control.

This is your no-fluff, plain-English guide to understanding what options are — and why traders use them.

📦 What Is an Option?

An option is a contract that gives you the right — but not the obligation — to buy or sell a stock (or index) at a specific price, within a specific timeframe.

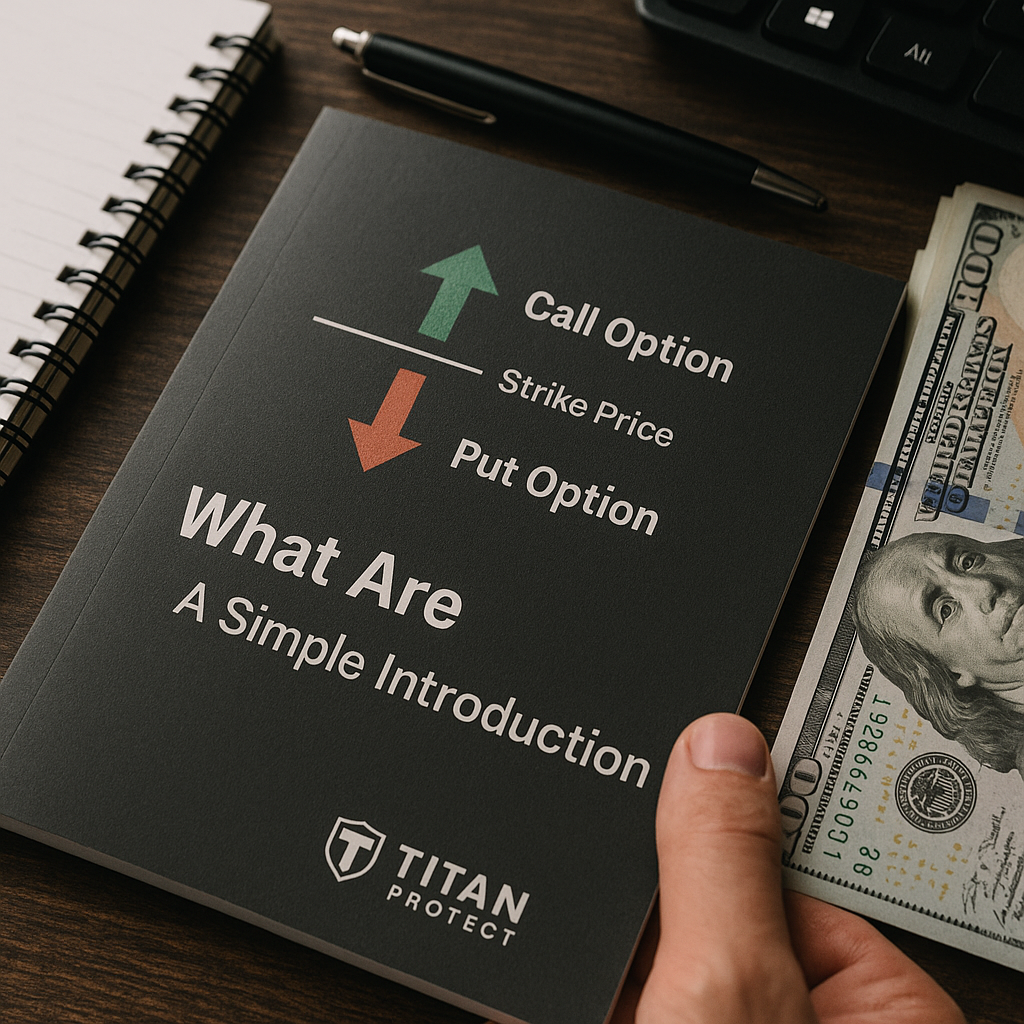

There are two types:

Call Option: Right to buy at a set price

Put Option: Right to sell at a set price

You don’t have to exercise them. You can also just trade the contracts themselves, which is what most traders do.

🟢 Example: Call Option

You buy a call option on SPY with a strike price of 500, expiring next month.

This means:

You have the right to buy SPY at $500 — even if it goes to $510 or $520.

If SPY rises, your call becomes more valuable.

🔴 Example: Put Option

You buy a put option on AAPL with a strike price of 180.

This means:

You have the right to sell AAPL at $180 — even if it drops to $170 or $160.

If AAPL falls, your put increases in value.

💰 Why Use Options?

Traders use options to:

Speculate

Leverage small capital for big moves

Profit from directional bets on movement (up or down)

Hedge

Protect a stock position in case of a reversal

Think of it as “insurance” for your trade

Generate Income

Sell options to collect premium (advanced strategy)

🧠 Basic Terms to Know

Strike Price: The price you agree to buy/sell the asset

Expiration Date: When the contract ends

Premium: The cost to buy the option

In the Money: The option has intrinsic value

Out of the Money: The option only has time value

⚖️ Risk vs Reward

Options offer:

✅ Big upside with small capital

❌ But they can expire worthless if the move doesn’t happen in time

This is why traders often say:

“Options decay. Stocks don’t.”

Understanding the time + price + volatility relationship is key to success.

🛡️ Learn With Titan

At Titan Protect, we don’t just show you where price is going — we help you understand why options activity may be behind it.

Our tools:

✅ Highlight price zones impacted by options flow

✅ Track time-of-day risk shifts (pre/post OPEX, etc.)

✅ Visualise potential trap areas based on smart money hedging

🧠 Connect expiry, volume, and structure for better setups

We’re building smarter retail traders — and that means introducing options the right way.