🛡️ Titan Signals

SPX Surges with Confidence, NDX Hesitates Again – Titan Panels Diverge

📆 Tuesday, July 23 → Wednesday, July 24, 2025 | ⏰ Pre-Market → NY Close

🎯 Trade Type Focus: Intraday, Macro, Scalp Overlay

🎯 EXECUTIVE SUMMARY

While the S&P500 (SPX) delivered a near textbook structural breakout with escalating panel conviction, the Nasdaq 100 (NDX) once again lagged — showing hesitancy despite bullish setups and multiple buy triggers.

The Titan Guardian Panels tell the story: SPX remained aligned from pre-market through NY close, even entering Ultra-Consensus Long territory. NDX, however, was a puzzle — frequent AI reversals, conflicted score, and fragile flow confirmation.

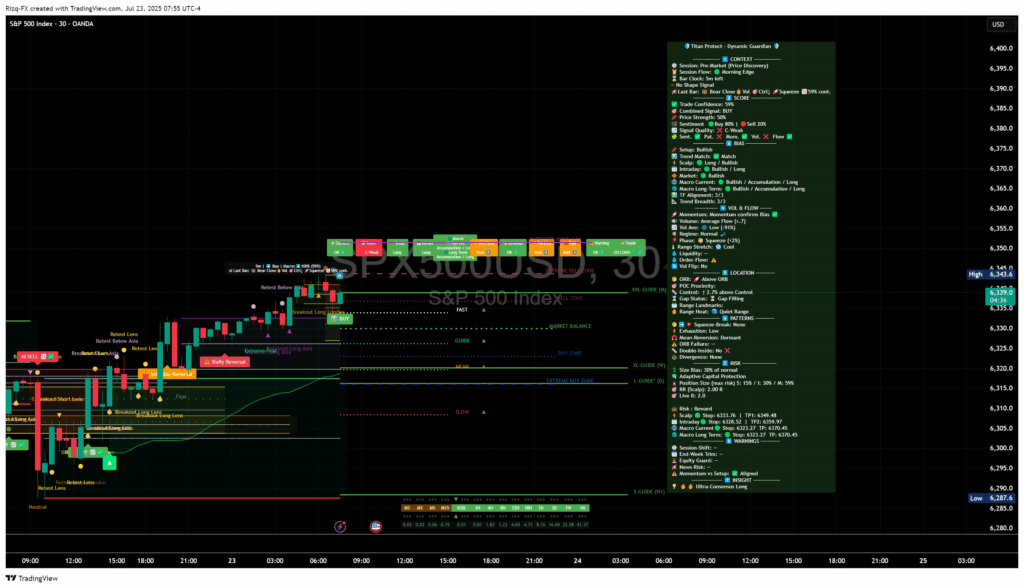

🔹 SPX500USD – STRUCTURED ACCELERATION

📍 Pre-Market to NY Close

✅ Price held above London High → XL Guide → ORB

✅ Signal Quality: B → A+ Go Long upgrade

✅ AI Buy → Breakout → Pullback retest → Expansion

✅ Final bar: Ultra-Consensus Long confirmed

✅ No warnings under Vol/Flow or Pattern

🧠 “Clean breakout structure. Flow, score, and signal quality remained intact across the session.”

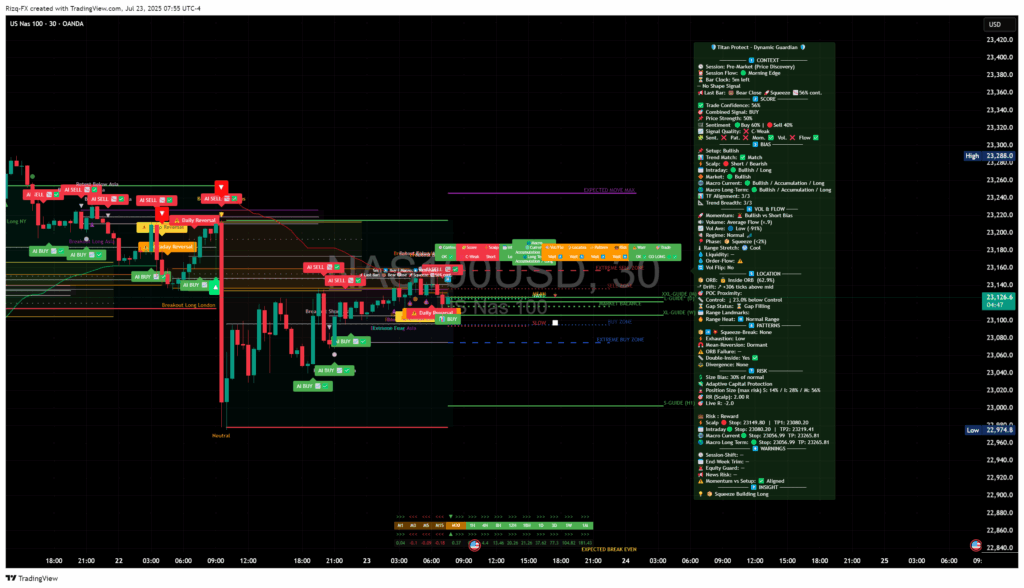

🔸 NAS100USD – TRAP AND HESITATION

📍 Pre-Market to NY Close

⚠️ Pre-Mkt Panel: Conflicted sentiment + weak score

⚠️ Intraday: Multiple AI Sell tags near XL Guide cap

🟠 Breakout above London High rejected; reversal printed into close

🔁 Closing bar: Score remained “C”, Vol/Flow = Wait

❌ No Ultra-Consensus, divergence vs SPX confirmed

🧠 “NDX moved impulsively, but Titan Panels never truly supported it. Risk was real — and it played out.”

🧱 DAILY TIMEFRAME CONFIRMATION

SPX500USD 1D:

✅ Ultra-Consensus Long

✅ Trend Breadth: 3/3

✅ Risk Profile: Low, no reversal tags

✅ Closed above all prior zone levels

NAS100USD 1D:

⚠️ Score = Weak

🟠 Vol/Flow = Wait

❌ Panel shows caution across Momentum, Pattern, and Risk

📍 Price pinned under the 23,300 XL Guide — rejection risk high

🔮 OUTLOOK FOR JULY 24, 2025

| Index | Status | Risk | Bias | Strategy |

|---|---|---|---|---|

| SPX | 🟢 Strong Trend, Ultra Consensus | Low | Bullish | Retest opportunities → Fast or Guide level bounces could reload long entries |

| NDX | 🟡 Fragile Breakout | Medium | Mixed | Avoid chasing; needs strong confirmation above 23,300 to reset structure |

🧠 “Expect SPX to lead — unless macro catalysts flip sentiment, stay selective on tech exposure. NDX must prove it belongs in the next leg higher.”

🧠 STRATEGIST TAKE

📌 SPX remains king: clear structure, aligned signal stack, and decisive leadership

⚠️ NDX still struggling with conviction and overhead supply

🎯 Focus for today: monitor if NDX clears XL Guide with confidence — otherwise, SPX remains the vehicle for directional bias

🔒 Members Only – Titan Session Outlook

🧠 How Might the Next Session Play Out?

📅 Wednesday, July 24 → Thursday, July 25, 2025

🔍 Forward Bias Projection from Final Guardian Panel States

🔒 Want the Full Panel Breakdown?

🛡️ The Titan Guardian doesn’t just show buy/sell — it decodes structure, flow, and momentum like no other.

This week’s divergence between SPX and NDX? The panel saw it coming.

✅ Get the full cheat-sheet,

✅ Detailed RR zones,

✅ Session forecast,

✅ Adaptive sizing — before the move happens.

🧠 Join Titan Alpha Access today → and trade what institutions track, not what retail guesses.

Best Wishes and Success to All

🛡️ Take Profits, Not Chances.

💰 Manage Risk to Accumulate.

🎯 React with Clarity, Not Hope.

Titan Protect | Market Structure. Flow Intelligence. No Noise.

⚙️ Views are Personal & Educational, reflective of our Analysis and Research.

📉 Titan Signal data reflects multi-timeframe trade setup detection as of July 24, 2025

✍️ Analyst: Titan Protect | Signals Division

⚠️ Educational content only. Not investment advice.

🔒 Visual Interpretation Only – Proprietary Indicators Not Disclosed